A Note From the Redbud VC Team

November was a packed month for Redbud VC! Between a host of travel and attending some fantastic events across Middle America, we are excited to be back in Columbia and continue the positive momentum heading into the end of the year. Brett Calhoun was named on this year’s Forbes 30u30 list for VC, representing Missouri! Capital continues to swell, and rates appear to have reached a peak. Expect a ton of capital deployment in H2 2024 as the bulk of the downturn will have shaken out the below-average investment opportunities, rates may come down, and capital must be deployed. Between a whirlwind of a week in AI, the promises of Cybertrucks, and the death of investing guru Charlie Munger, there’s much to catch up on. US stocks slightly rose due to the increase in US consumer confidence and hopes that the Fed is finished with rate hikes (just in time for new tax brackets to be launched). US economic growth is strengthening as GDP has risen 4.9% this quarter, which was the strongest GDP rise since Q4 2021, sending more positive and confident signals into the market.📈Private tech company valuations are on the rise, especially at later stages, and IPO speculations have already begun for 2024. Before getting too excited, how long can our economy sustain these rates before the dominos start falling? 🤷

Redbud VC invests monetary ($50k-$150k) and social capital in early-stage tech founders. We’re excited to bring you monthly Redbud VC, tech, and economics updates. - We've filtered thousands of sources for our 14k+ readers, so you don't have to. Enjoy🥂

🦸🏽 Become a Redbud VC Mentor | 🏉 Meet the Redbud Team

😎 Join our talent network | 🛩 Flyover Tech community

The Sam Altman firing/re-hiring saga from this month spurred investor and tech community chaos and a host of great memes! 👏🏻

🔥 Burning question of the month 🔥

After a crazy 72 hours of firing Sam Altman, 700+ employees threatening to leave, lead investor Microsoft “didn’t know,” and then Sam Altman returning, did Sam know something, or was this backdoor to another scheme?

What does Sam Altman know?

📈 Macro Trend Report

ECONOMY | There was a wealth of insights in SVB’s H2 2023 State of the Markets report. There is some gloom in the short term but signs of rebounding in 2024. Our favorite insights + more are below:

Funds will raise 50% less in ‘23 from ‘22. That said, dry powder is at an all-time high at $238B. Late-stage valuations are reaching a floor, and early-stage deals are down 36%. Although nearly 50% of startups must raise their funding by mid-2024, it is still well below historical levels.

The federal funds rate is at a 22-year high. 47% of banks are tightening lending standards, and the demand for SMB loans is down 53%.

Corporate profits have dropped at the highest rate since the pandemic.

VC-backed M&A is expected to be at a 7-year low in 2023.

This will change in 2024 as investors raise funds to buy out startups.

Endowments face decade-low performances.

AI | Let’s face it: the four days of chaos after the Open AI board fired Sam Altman for “not being consistently candid in his communications with the board” is the top story this month. The abrupt announcement of Altman’s departure triggered a host of statements, hirings, and hush-hush meetings. Just three days post-announcement, Altman and other Open AI leaders joined Microsoft to lead their advanced AI research team. And on the 4th day, Altman was reinstated as CEO. The board that voted to remove Altman had its fair share of shakeups over the past four days, with former Treasury Secretary Larry Summers and Adam D'Angelo, co-founder of Quora, joining the board and independent directors Tasha McCauley, Helen Toner will leave the board, as will Ilya Sutskever, OpenAI's chief scientist. A clear picture of what happened has yet to emerge, but tensions were high between Altman and the board, and the firestorm of reactions was not anticipated. OpenAI’s competition has been circling as a spokesperson for Cohere stated that people “want outstanding, reliable business solutions, not soap operas.” 🙃

M&A | The EU is cracking down on big American tech mergers. Adobe’s $20B acquisition of Figma, announced last year, could face a veto. The EU’s Competition and Markets Authority thinks the deal might stop fair competition in product design software, slow the creation of new products, and take Figma out as a competitor. A list of objections was sent to Adobe this month. Amazon is dealing with its own list of “to-do’s” as EU antitrust regulators remain skeptical of competitive landscapes pertaining to its $1.4B acquisition of iRobot. Outside of global affairs, trendy hometown Chicago food retailers Foxtrot and Dom’s Kitchen & Market are merging in an all-stock merger to create an entity called Outfox Hospitality. Foxtrot and Dom’s Kitchen are backed by top VCs such as Lerer Hippeau, Cleveland Avenue, and Revolution.

IPO | The whispers of IPOs remain persistent, as there hasn’t been much traction since Instacart and Klayvio went public in September. Reddit has tiptoed around IPO talks since 2017, when the company aimed to go public by 2020. They ended up filing privately to do that in late 2021 and then let 2022 pass them by. As 2023 is coming to an end, Reddit has set its sights on 2024, engaging in early talks with investors. Fashion powerhouse Shien has quietly filed for IPO this week. The online fast-fashion retailer has faced a host of regulatory, climate, and ethics concerns since its founding in 2012. Shien has already been investigated by two congressional committees, and the SEC has been asked to run an audit on the company whose goods enter the US duty tax-free. Finally, Kim Kardashian’s shapewear unicorn SKIMS is exploring an IPO for 2024. SKIMS closed a $270M funding round earlier this year that valued the brand at $4B. Adding Reddit, Shien, and SKIMS in addition to the 1,200+ SaaS companies eyeing an IPO.

VENTURE CAPITAL | The pre-seed and seed markets have remained firm against market headwinds. Thanks to the surplus of small VC funds deploying capital and qualitative-focused due diligence efforts, pre-seed and seed deal metrics have been kept alive and even contributed to record highs. The Q3 median seed deal size of $3.3M is the highest since 2020. Late-stage valuations are also rising, even though the deal flow is not. The valuation uptick for Series C and D+ startups in Q3 2023 saw their median valuations jump 54% and 43% QoQ, respectively. However, the deal count has decreased compared to recent years, suggesting that this valuation bump is just a reflection of “higher-quality” startups being able to raise while the rest are left behind.

It seems like we’ve stabilized to a sustainable market. Past market cycles have taken between 12 and 18 months to find a bottom. June marked the 18th month of this cycle, bringing VC investment in the US back to pre-pandemic trends. Down rounds persist as Q2 2023 had the highest share of down rounds at 12.6% since Q4 2017 at 14.8%. A majority of the down rounds are occurring at the late stage, where more public comps are available, and the market to raise is much more cutthroat.

Souce: Pitchbook

💰 Micro Trends

MID-AMERICA METROS | St.Louis is striving to become the Construction Hub of the US with its new Gateway South Initiative. The $1.2B revitalization project will create a 100-acre mixed-use district that will be the destination for the design and construction ecosystem to share ideas, efficiencies, and top talent. A modular housing design competition will be held this month for university students to showcase sustainable and innovative housing designs. Construction development firm, Clayco, announced that they will be relocating and expanding their presence in St.Louis, which will include investing $50 million and creating 400 new jobs. Outside of St.Louis, Columbia took the crown for the healthiest place to live in Missouri.

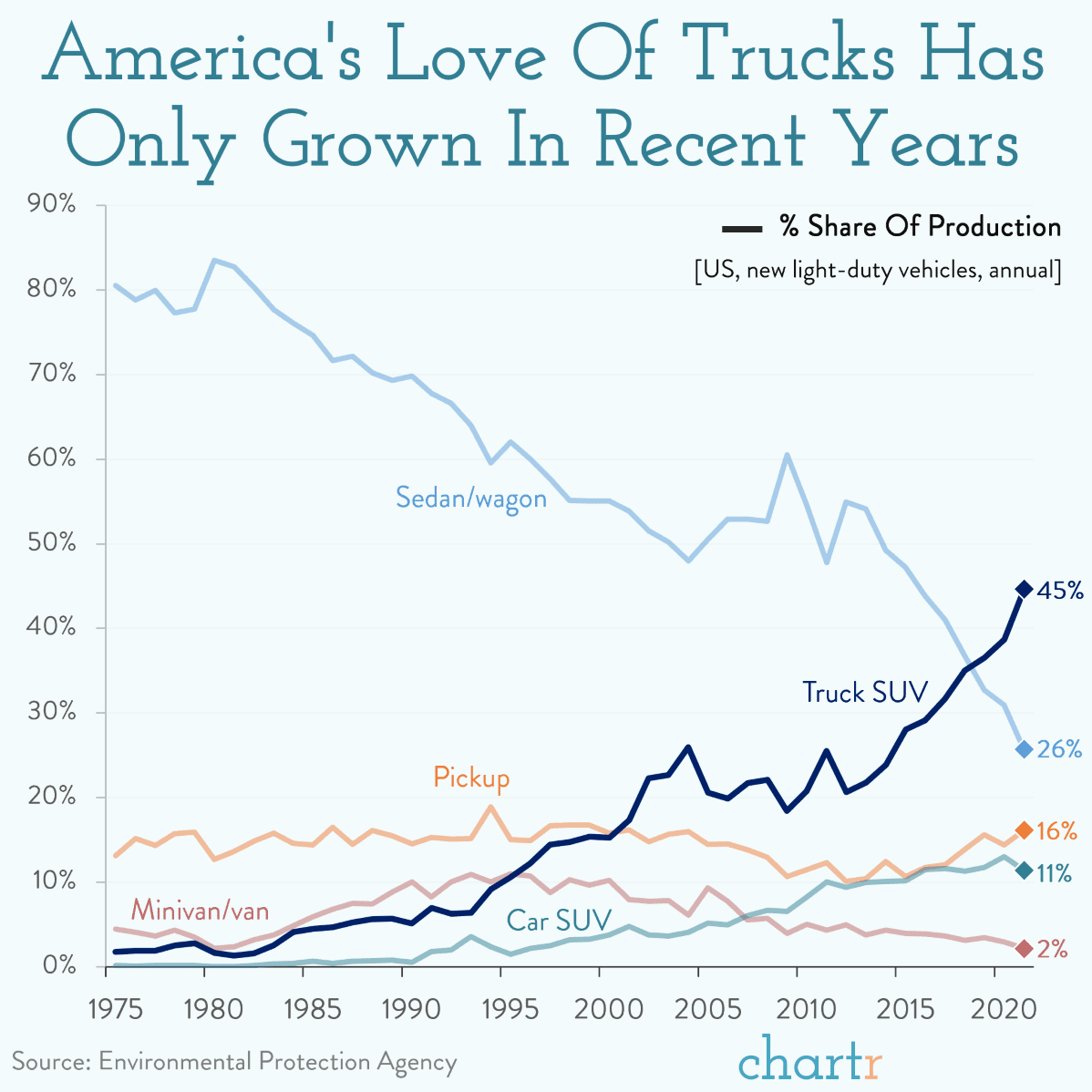

CYBERTRUCKS | Tesla is set to roll out their first batch of Cybertrucks this week, and there are still a lot of unknowns. The specifications of the model, price, and who will even get one are still up in the air - even though some of the specks have been leaked 👀 Elon tweeted this week that “Cybertruck deliveries will start on Thursday,” exciting those who have long awaited the “blade runner of pickup trucks.” The 2-year delayed release of the truck can be attributed to a host of production and supply chain issues. The debate is on whether Cybertrucks will be the next big thing or if Tesla has already missed the mark. Regardless, entering the truck market is a logical move for Tesla, given the widespread dominance of trucks on American highways across all states. According to EPA data, the "truck category," encompassing SUVs, pickups, vans, and minivans, constituted 63% of the total vehicle production in the US in 2021, surpassing cars three years prior. Tesla stock has gained around 22% in November ahead of the Tesla Cybertruck delivery event.

MARK CUBAN | There’s been lots of news revolving around Mark Cuban’s activities this month. Last week, Cuban shared that this season of Shark Tank will be his last. Don’t worry; we will still be quoting “for that reason, i’m out” in his memory. Cuban also announced that he will sell his majority ownership stake in the Dallas Mavericks to the Sans Casino family. Cuban bought his stake in the Mavs in 2000 for $285M, currently valued in the $3.5B range. Much speculation about what Mark will do with his new “free time,” including running for president, which he has denied. Some speculate that Mark will build a new “thing” in Mustang, Texas, the small town he bought in 2021. Whatever it is - we’re anxiously awaiting updates on Mark’s next project. 🤠

📰 Middle America Headline of the Month

The 2024 Purpose Award Winners were announced this month, and there were many familiar faces! Summersalt Co-Founder and Redbud VC advisor Lori Coulter was selected as a winner alongside top Midwest founders, funders, and ecosystem builders. Lots of big-time builders here in the Midwest 🛠

💰 Flyover Deals

It feels like flyover funding rounds were either big or small this month, not much in the middle. We’re looking forward to seeing all the great deals that close with the end-of-the-year fundraising push 👀

Check out the 236 flyover deals for over $2.2B in funding we tracked here.

Workplace food software Fooda closed a $17.8M Series C funding round

Chicago-based Mozaic closed a $20M Series A led by Volition Capital

Revela, a Detroit-based property management software, wrapped up a $9M Series A

Warrenville, IL-based Fynite closed an $800k Seed to advance the AI-enabled supply chain

Two big funding rounds were closed by Nebraska-based startups this month 🌽

Internal comms platform Workshop closed a $12M Series A round led by McCarthy Capital

Orthopedic device company Centese closed a $15M Series B round

🐮 Middle America vs. National Macro Trends

The CPI and employment front have been steady over the past 3-4 months. Both indexes have had their fair share of consistent inclines and declines throughout the year, and the Fed hints that rate increases are over! Seems like things have become slightly less tumultuous as we near the end of 2023 👀

Unemployment in Missouri rose slightly this month to 3.1%, but still well below the steady national average of 3.9% and the Midwestern average of 3.5% ✅

The Midwest Consumer Price Index was at 3.1% this month, below the national rate of 3.7% ✅

🧠 This Month's Recommendations

📚 What We’re Reading

Brett Calhoun, GP at Redbud VC, was named on the ✨Forbes 30u30 list ✨, representing Missouri on the list. We’ve loved reading about all of the excellent investors on the list this year - check the full list below ⤵

Lost cash on NFTs → you aren’t alone

Binance CEO out and pleads guilty to anti-money laundering charges and set to pay $50M

Throughout a week of shakeups and instability, everyone is asking what comes next with Sam Altman’s Open AI?

No room to grow🌿- a look at how we have been feeding the planet and where there is room for innovation in the future

In case you missed it, applications to present at the 2024 InvestMidwest Conference in Kansas City are now open until December 4 🛑 . Historically, companies have had success raising millions at the event. This is an opportunity for companies across North America to connect with investors from Middle America and beyond. Apply to pitch to hundreds of investors here.

🎧 What We’re Listening To

Celebrate Charlie Munger’s 99 years by listening to his insights on My First Million podcast [44 min]

The Turpentine VC podcast has become a recent favorite 👋🏼

Logan Bartlett shares his thoughts on current venture trends and predictions alongside what Redpoint is doing to bet on the best [62 min]

We also are big fans of Redpoint VC’s TikTok page 🎶

Listen to Jing Gao talk about the founding of Fly by Jing, how her brand has become one of the hottest things in food, and how to build without losing your identity [53 min]

Watching 👀: Nick Adams Reveals Key Insights for Startups Seeking Seed Funding [21 min]

📆 What We’re Doing

It’s been a busy month of travel for events and holidays, and there’s more to come! ✈️

We had a blast at MidxMidwest! Flyover Capital did a fantastic job organizing the wonderful event full of connections and conversations.

Thanks to our friends at Mercato Partners for hosting a Funders and Friends dinner at the Crossroads Hotel. We loved meeting all the excellent founders 🥂

The inaugural Main Street Summit held in Columbia, MO, was well executed. We loved meeting some rockstar investors and operators from across the world💪

We hosted a tailgate for the last Mizzou home football game with our friends at Holder, Susan, and Slusher. We indulged in some local favorite foods, and we can’t wait to cheer on the Tigers in *hopefully* a New Year Bowl Game 🐯

Prepping for Missouri Startup Weekend on April 5-7, 2024, stay tuned for details 👀

🪝 Flyover Picks of the Month

📍Victoria, BC

Streamlined workflows and automated fraud detection for trade credits.

🚀 Redbud Portfolio Company Highlights of the Month

Meet our investment in Transend! Transend is a private-label working capital financing and underwriting platform that helps businesses do more. Operating as a B2B software engine for growth, Transend gives buyers access to capital at the point of commerce, suppliers increased cash flow, loyalty offerings for suppliers and buyers, and banks access to immediate deal flow.

Find out why Transend is set to revolutionize the US's antiquated trillion-dollar financial services business lending ecosystem. 💰 🌆

Congratulations to portfolio company Mattoboard on collaborating with Behr to launch all Behr colors on their platform! 🎨

🛠️ Resources

Did you recently close a funding round? Want to be featured on a Times Square Billboard? Drop a line here 🎣

Apply here to pitch and be featured at Invest Midwest 2024

Pitching can be difficult - check out this elite resource on pitching to VCs by Vik Kolsa + notes + takeaways!

This Founder + Funder matching tool helps founders fund the right investor and vice versa

Emerging managers → here’s Pitchbook’s guide on how to raise your 1st VC fund

Here’s a list of the top 30 startups and when they hired thier first PM

Looking for something fun to browse? Check out the Failure Museum’s list of companies, products, and toys that have failed over the years 👺

Need an idea of what to put in Investor updates? Check out a breakdown of Front’s investor updates by First Round Capital.

📸 Screenshot to code tool - this one is for all our non-technical founders out there!

Metrics that matter: what a consumer VC looks for in a start-up’s numbers

Unlock the power of a data room - check out all the must-have docs and how to build a collection of data investors love. ⚡️

The Q3 Valuation Data and insights are here! Take a look at what the market is looking like stage by stage.

If you’re an early-stage founder, you have to check out this list of 1,000+ early-stage check writers

Resource page for founders we made here 📒

🤝 Collaborate with funds & founders in our Flyover Tech community

The information provided in this newsletter is intended for general understanding and educational purposes only, not as a guide to investment decisions. The authors, publishers, and distributors of this newsletter are not licensed financial advisors and are not providing financial advice or investment advisory services.3