PRESENTED BY

A Note From the Scale Team

This month, as we officially launched Cohort III and started looking toward next year, we were reminded that we have so much to be grateful for! Even as markets go crazy, we remain steadfast in our optimism about our companies, founders, and tech building between the coasts. 🦾

Scale invests first checks into fearless founders and accelerates access to capital, talent, networks, and knowledge. We’re excited to bring you monthly updates about Scale companies and the state of tech startups and investing in the Midwest. - We've filtered through thousands of sources, so you don't have to. Enjoy🥂

The #1 thing you want to optimize for with fundraising is dilution. At the Pre-Seed & Seed round individually, you should budget to sell 15-20% of your company. Although you want a higher valuation, you also want fair pricing that won’t set you up for failure in the next round. If you build a billion-dollar business, you should expect roughly 60% dilution to that point. If you don’t execute or price yourself too low/high, you could end up with an 80%+ dilution.

Join our talent network to be the first to hear about founder opportunities at Scale Venture Studio companies or founding team jobs at our startups 😎

🤝 Collaborate with top funds & founders in our Flyover Tech community (Join here)

As painful as it is, Sam Bankman-Fried and FTX pretty much represent the investment rationales made in 2021😅

💰 Midwest Economics

Major congratulations to our friends at EquipmentShare for unveiling their plans for a new headquarters in our hometown, Columbia, MO!

Heartland Ventures, the VC firm dedicated to connecting Midwestern customers with technology from coastal hubs, closed a $52M Fund II. We cannot wait to see how their unique model of investing and worldview continue to bolster the region!

Favorite Midwest and Southern grocery, Kroger, launched their high-tech "store of the future" in the Cincinnati area this month!

High Alpha Ventures announced a collaboration with University of Notre Dame's IDEA center to facilitate on-campus investment. Hey, Mizzou! Where's ours?

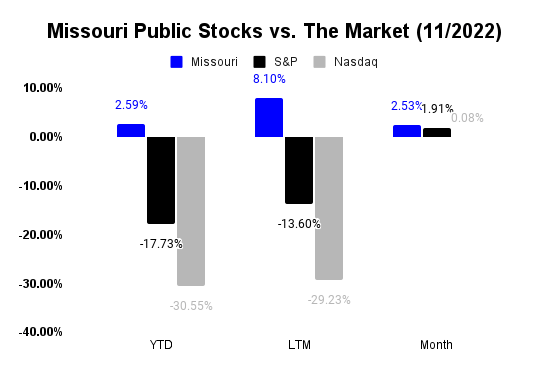

Missouri public companies have outperformed the market in four of the last five months. Our theory is that the Midwest is used to constraints; therefore, economic downturns fuel the fire. What's yours?? 🤔

A MESSAGE FROM FWIW

For what it’s worth, you may be missing out on another amazing newsletter called…For What It’s Worth (FWIW).

FWIW hits your inbox on Thursdays with the latest resources, news, and trends you need to confidently align your investments with your values

FWIW is not in the business of trying to predict the future with individual stock recommendations (which we’ll leave to your all-knowing friend of a friend)

Learn how to find good returns from companies whose values you agree with. You can subscribe to this free newsletter in just one click. Seriously… one click.

💰 Midwest Deals

Minnesota-based Låkril Technologies received pre-seed funding from numerous Midwest based funds to build corn-based alternatives to petroleum adhesives.

WorkTorch, a Kansas-based HR platform, announced a $2.2M seed round, led by Tenzing Capital, AND rebranding to keep up with the rapidly changing hiring landscape.

Kansas City-based Saile raises $1.35M seed round to build the future of "robots for salespeople".

Check out the 79 deals we tracked this month here!

🐮 Midwest Macro Trends

Unemployment in Missouri remains well below national and Midwestern rates at 2.6% for the state ✅

Missouri’s Purchasing Manager Index increased to 54.9 moving above the national and Midwest indices for the first time this year ✅

Midwest Consumer Price Index rose to 7.7% compared to the national rate of 7.9% 🔺

Check out our friends at the Startup Founder Daily, where they do free features on founders👇

📈 Macro Trend Report

INFLATION | In late November, a Senior Federal Reserve official stated that inflation could remain high into 2024 (i.e., above 3% annually).

TECH EMPLOYMENT | Tech layoffs continue to heat up as we approach 2023. There were more layoffs (50k) in November 2022 than in Q3 2022 (35k). The biggest is coming from Meta, who laid off 11k employees.

HOUSING | The housing market has been nothing but up and to the right for investors over the last decade, but with the current rates environment and other macro forces will we see a market crash in 2023? Rates have more than doubled in 2022 as opposed to 2021 and housing prices have already started a slow decline. Home sales are now back to pre-pandemic levels.

VENTURE CAPITAL | Secondaries funds provided an attractive alternative for VCs amid this year's changing conditions. They emerged as a leading private equity performer as many notable public companies' valuations this year (think: Lyft and Oscar Health) sank below their private capital raised. Despite the tech industry heading into a bear market, investors are still pouring their capital into VC funds

Compared to 2021, angel deal value has remained unchanged, while Seed values have increased roughly 25% on average. Seed pre-money valuations have maintained a four-quarter streak median of >$10M. Early-stage VC deal values are unchanged, but valuations continue to rise. [Pitchbook Q3 2022 US Valuations Report]

🧠 This Month's Recommendations

📚 What We’re Reading

How and when to build relationships with VCs as an early stage founder

The importance of looking outward and building a pipeline-forward culture

What we have to look forward to next year...

🎧 What We’re Listening To

It might not be a how-to guide, but it is a great listen on how to become a top 1% PM from Lenny's Podcast [65 minutes]

Interested in how a venture fund operates? Check out the most recent 20VC podcast with Semil Shah of Haystack Ventures [65 minutes]

Listen in to the Full Ratchet to hear about valuation inflation, the IPO Pause, the state of M&A, Twitter, and how to construct a successful board [44 minutes]

📅 What We’re Doing

Attending midwest.tech, a virtual summit and online meeting platform to bring early stage Midwest investors and founders together: 11/28-1/31/23

Attending The LegalTech Fund Summit on December 7th-9th alongside three Scale companies, including Kaveat who is participating in the Startup Showcase

Telling our favorite underrepresented founders to apply for Visible Hands: applications close 12/15

Join us with our invite code here in launching tech ideas with our friends at Kernal (started by Ryan Holmes founder at Hootsuite), a growing community of 10k+ qualified founders, builders, and investors focused on validating pre-seed startup ideas (2k+ ideas with over 250 executed to MVP already!!).

🎮 Midwest Tech of the Month

Chicago-based Canopy Aerospace is building a commercially viable thermal protection system (TPS) factory for the space and defense industrial base. TPS protects spacecraft during the destructive environment of re-entry, vehicles traveling above Mach 5, and military weapon systems.

🚀 Scale Portfolio Company Highlight of the Month

As we get excited about Columbia Startup Weekend in 2023, we are excited to reflect on last year's winner - Appreciate - and their incredible growth this year! Will they be the 3rd $B tech company to come out of Columbia Startup Weekend?

🛠️ Resources

Check a list of dozens of fundraising resources we cobbled together here 🤑

It's extremely important to have well-thought-out messaging when reaching out cold to investors, so we put together some resources here 🥶

Have trouble forecasting your dilution? Find our handy Cap Table + Dilution Calculator here 📒

Useful website for founders here 🌐

Need help with your deck, get-to-market, product, or cash burn model? Sign up here for a chance to win a 1-hour strategy session with our team ⛑️

Why should you angel invest? Because Venture Capital is the sexiest asset class that improves society while producing outsized returns, duh. Also, venture returns have proven to outperform public equities during a recession. -> If you are interested in angel investing, then sign up here 😇

Keep up with our content Medium content here 🔖

💼 Scale job openings --> here