A Note From the Redbud VC Team

As we approach the second half of 2023, there has been a limbo over the last quarter regarding the future of the US and the global economy. What is concerning is most financial institutions (e.g., banks and insurers) are underwater on their balance sheet (i.e., devalued investment bonds). In addition, public and private companies that are highly levered through bonds maturing in the next 18 months will be refinancing with 5x+ the interest expense, possibly going underwater with their coverage ratios. This begs the question of large rounds of layoffs if the Fed decides to maintain or increase rates 👀 At Redbud VC, our positive outlook stays constant as we aim to continue backing amazing founders regardless of the climate — we even made two investments last month (see one here).

→ Sourcing Pre-Seed/Seed founder — request an intro here

Redbud VC invests monetary ($50k-$150k) and social capital in early-stage tech founders. We’re excited to bring you monthly updates about Redbud VC, tech, and economics. - We've filtered thousands of sources for our 12k+ readers, so you don't have to. Enjoy🥂

🦸🏽 Become a Redbud VC Mentor | 📣 Pitch Us for an investment

😎 Join our talent network | 🛩 Flyover Tech community

After experiencing the first six months of 2023, is anyone surprised that two billionaire tech bros might have an MMA fight? Tbh, I’d pay to watch. 🥊

Who is winning in a boxing match?

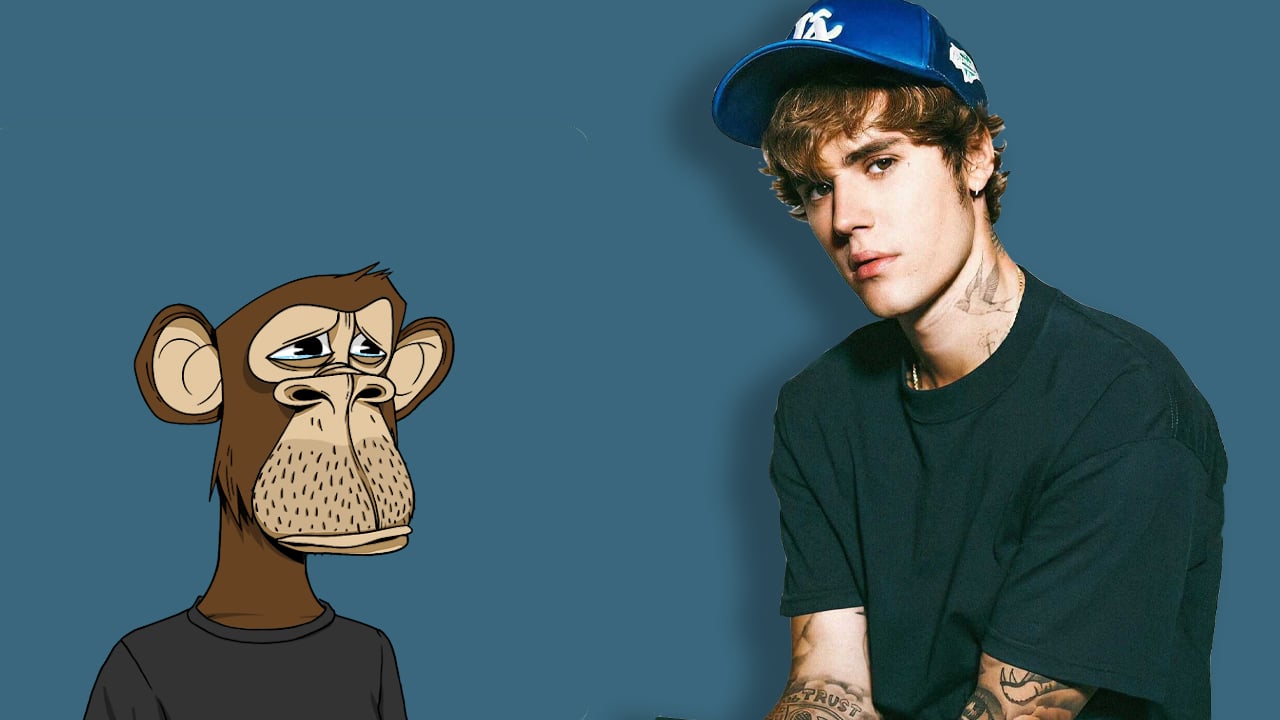

One last laugh, Justin Bieber’s $1.3M Bored Ape NFT purchase to join the rich & famous ape club is down 95% to a whopping $59k. BAYC’s site traffic is also down 70%!! Did anyone else see this coming? 😅

🔥 Burning question of the month 🔥

📈 Macro Trend Report

HOUSING | Although rates increase, housing prices continue to rise, pushing 2023 to be the most unaffordable year ever for housing. After four consecutive months of price increases, a household needs at least $75k in income to buy a home in half the US markets. If you’re waiting to buy a house, forget about it; prices are not coming down anytime soon. The main driver of price increases is an increasing housing shortage and demand (not AirBnBs), which is not an overnight fix, and is tough to say it will ever be fixed with the lack of construction labor and chaos in the supply chain.

EMPLOYMENT | Chatter about a “tech to gov” pipeline has emerged as Federal, state, and local government tech job postings soared 48% in the first three months of 2023, and people look for more “secure” jobs. Especially as Ford announced it would be slashing 1,000 jobs this week and Robinhood cut 7% of its full-time employee base…yikes. That said, tech layoffs have slowed for the sixth consecutive month.

AI | The debate continues on whether AI will save the world or destroy it. Countries scramble to piece together AI legislation, and the European Union looks to be at the forefront, and Elon Musk says that China is not far behind. Meanwhile, Open AI continues to introduce updates to its APIs as they look to roll out an app store for AI software.

VENTURE CAPITAL | Through Q4 2022, PE and VC are generating lower returns and lagging behind their 10-year averages. Dive into the data here. We all know the earlier stages are somewhat sheltered from market downturns; therefore, in 2023, the median pre-money valuation increased ~5% while the mean decreased ~14%, indicating low outlier valuations. Overall, in the earliest stages, the biggest change is the deal values, which is expected when there is less capital and companies are cutting burn forecasts. What has held resistance is the rate of down rounds, which we expect to change at the end of 2023 and early 2024 as later-stage companies start running out of the excess cash they raised during the pandemic.

💰 Micro Trends

CULTIVATED MEAT | Upside Foods and Good Meat have been approved to sell their cultured meats in the US. This could be a pivotal moment for a potential long-term sustainable protein source. 🌱 🐥

FUND MANAGERS | Emerging VC managers are on pace to raise the least capital in the last decade despite having the highest returns. That said, the decrease in emerging managers raising as a percent of the total is down across all alternative asset classes. In some cases, it’s not just emerging managers; Insight Partners also cut its latest fundraising by nearly 95% [$20B → $1.3B]. See the chart below for the decrease in emerging managers’ percent of total fundraising [down 11%-69%]:

COLUMBIA, MO | Two Columba, MO-founded companies, Zapier and EquipmentShare, made the Y Combinator top 50 revenue companies list. Columbia, MO ranks #1 for blending walkable urbanism with affordability.

MISSOURI STOCKS | Did you invest in the S&P 500 last summer? The market has been soaring in 2023—Missouri public stocks with a strong rebound (up ~6%) after a rough couple of months.

The Kansas City Pioneers are the largest gaming and esports organization in the Midwest. The Pioneers compete against the largest esports organizations in the world and have won several world championship-caliber teams in 5 esports. Several Super Bowl Champions and popular creators have joined as brand ambassadors, reaching an astonishing 100M people annually, attracting national and regional brands such as Logitech, c, DoorDash, and Price Chopper. With all this momentum, the Pioneers are on pace to eclipse $1 million in revenue this year alone and finalizing its seed round with a remaining $700k on the $2M note; if you are interested, reach out to CEO Mark Josey, [email protected] to chat further through this opportunity.

💰 Flyover Deals

Check out the 174 flyover deals totaling $1.6B in funding we tracked here.

Our friends at KCRise Fund closed a $34M Fund III to support startups in the Kansas and Missouri regions.

Ann Arbor-based Blumira raised a $15 million Series B to launch a new XDR security platform.

Bitewell, a Denver-based healthy food marketplace that works directly with employers to provide food health benefits, closed a $4 million fundraise this week with Alex Morgan’s Trybe Ventures participating.

Fishers, Indiana, saw After School HQ complete a $3 million seed round earlier this month.

Ohio saw some big wins!

Columbus-based Inversa completed a $7.7 Million round to advance topical eyedrop formulas for ocular DNA damage.

Cleveland-based Axualla closed a $20 Million Series B to help healthcare organizations optimize their workforce.

Google awarded $150,000 in grants this week to five Chicago-based, minority-founded tech companies as part of its Black Founders Fund and Latino Founders Fund programs.

🐮 Flyover vs. National Macro Trends

Unemployment in Missouri remains low at 2.5%, well below the “increasing” national average of 3.7% and the Midwestern average of 3.2% ✅

Thanks to decreasing energy prices, the Midwest Consumer Price Index was at 3.7% this month, below the national rate of 4.0% ✅

🧠 This Month's Recommendations

📚 What We’re Reading

New tech titans are a rising wealth class with a competing vision for the world against incumbent elites - you won't want to skip reading up on Silicon Valley’s Civil War.

Maybe the public markets aren’t that bad…but maybe CAVA’s IPO is getting our hopes a little high.

DeepMind's co-founder thinks that AI models should be tested on a Turning test by taking $100,000 and turning it into $1 Million.

🎧 What We’re Listening To

On Category Visionaries, Brett Calhoun, GP at Redbud VC, talks about their approach to investing in and supporting founders from the middle of the country. [23 min]

Listen to Meagan Loyst on the Calum Johnson Show talk about integrating the GenZ perspective into teams, products, and services. [54 min]

Check out what David and Michael at Y Combinator have to say about the secrets you can learn from your customers. Spoiler alert: there’s no whispering. [15 min]

What’s for Dinner? Well, according to Fidji Simo, the CEO of Instacart, AI will be able to tell you soon! [40 min]

📅 What We’re Doing

Spent time talking with founders and investors on Propellant Ventures’ latest Generative AI panel.

Our friends at Cooley hosted an ecosystem mixer in Kansas City this month, and we can’t wait for their next visit!

We will be judging the upcoming Arch Grants startup pitches for the 2023 cohort to win $75k-$100k in grant funding — good luck, founders!

Sending our best regards to our friends in Chicago for the upcoming Chicago Tech Week on July 10-14.

🎮 Flyover Tech of the Month

Florida-based Purple is building the first digital “ABLE”-qualifying checking account. ABLE is a state-run savings program for eligible people with disabilities in the United States. The catch is it is tough to stay within the qualifications due to the complex regulations, but Purple makes it easy for families and those with disabilities to maintain.

🚀 Redbud Portfolio Company Highlight of the Month

Meet our latest investment, Trestle! Trestle is a SaaS platform streamlining the messy, time-consuming, and frustrating contract and vendor management process for contractors. The Trestle team leads with deep roots in the construction space and competitive technical expertise, and we are so excited to be their latest partner.

🛠️ Resources

Investors, here is a thread on how to calculate the future return of an investment — founders, this is why VCs are so adamant about the size of the market opportunity 🧮

Emerging managers, check out these decks that helped VCs raise $500M+ 🫰

Hey Founders, stop spending $$$ on expensive lawyers too early. Take a peek at these templates instead 💼

Everything you need to know about Minimum Viable Positioning for your startup - right place, right time 📍

“How much should I raise?”😵💫 No worries, here’s a framework!

Find the best tech conferences and events that are left in 2023

Check out the Redbud VC Mentor Network with 100+ mentors 🦸🏽

Resource page for founders we made here 📒

🤝 Collaborate with funds & founders in our Flyover Tech community

💼 Redbud job openings --> here

The information provided in this newsletter is intended for general understanding and educational purposes only, not as a guide to investment decisions. The authors, publishers, and distributors of this newsletter are not licensed financial advisors and are not providing financial advice or investment advisory services.