A Note From the Redbud VC Team

New year, new edition!! We’re heading into 2026, with markets moving at a breakneck pace 🏃🏼♀️ AI is everywhere, but struggling to prove its worth, and a lot of it is “slop.” Financial innovation is running ahead of its guardrails, and even something as simple as ordering groceries is starting to feel… personalized in the wrong ways. Across tech, finance, and venture, the word of the month is ~calibration~. Expectations are resetting, incentives are being exposed, and the gap between what sounds transformative and what’s actually driving returns is becoming harder to ignore. And as always, if you’re building something durable, thoughtful, and not powered by slop, we want to hear about it. Pitch us here.

Redbud VC invests $250k-$500k in early-stage tech founders. We bring monthly Redbud VC, tech, and economics updates. - We've filtered thousands of sources for our 15k readers, so you don't have to. Enjoy 🥂

We could see some big IPOs on the horizon in 2026, but rumor has it Databricks is gearing up to raise a Series M (insiders only 😉)

🔥 Burning question of the month 🔥

Do contrarian or consensus bets have more potential for outlier returns?

📈 Macro Trend Report

AI | and the word of the year is SLOP!! Merriam-Webster crowned “slop” as its Word of the Year, defining it as “low-quality digital content mass-produced by AI.” Ouch. Three years after ChatGPT kicked off the modern AI boom, slop is just about everywhere, and some enterprises are still struggling to turn AI into ROI. An MIT survey found that 95% of companies say they aren’t seeing meaningful returns on their AI investments. While many companies don’t feel they’re seeing ROI, another MIT study estimated that nearly 12% of jobs could already be automated with existing AI capabilities. Companies are increasingly citing AI as a reason to cut entry-level roles or conduct layoffs. That fear is now colliding with regulation. After a string of troubling mental-health incidents involving AI chatbots, dozens of state attorneys general sent a message to the major AI players demanding safeguards against “delusional” or psychologically harmful outputs. Their ask? Independent audits, incident reporting, and real oversight, even as a broader tug-of-war brews between state and federal regulators over who gets to set the rules. The era of awe is fading. The era of accountability is just getting started.

IPO WATCH | We’ve been saying the IPO iceberg melt is “coming soon” for years, but 2026 might finally be the year! SpaceX and Anthropic are topping many IPO watchlists as both look for fresh capital and a little competitive insulation. SpaceX, which reportedly raised money in July at a $400B valuation, has only widened its lead since, launching more payload into orbit than the rest of the world combined (yes, really). With reusable rockets getting cheaper and ambitions stretching from Starlink to Mars, a public debut would be less about validation and more about scale. Crypto exchange Kraken is another one to circle. After insisting in March 2025 that it was in “no rush” to go public, the company quietly and confidentially filed for an IPO in November, just one day after raising new funding at a $20B valuation. Motive, the fleet management and driver safety startup, has been laying the groundwork for its IPO, hiring JPMorgan Chase in August to lead an offering alongside Citi, Barclays, and Jefferies. And then there’s Discord: the gaming adjacent messaging app that walked away from a $10B Microsoft acquisition in 2021. According to the New York Times, Discord was back in early IPO talks as of March 2025, and while there hasn’t been much chatter since, 2026 could be their year 👀

VENTURE CAPITAL | Seed-stage venture is split into two different worlds, and everyone knows which one they want (or can afford) to live in.🌎 Carta’s State of Startup data shows the median seed valuation has crept up steadily over the past eight years, landing around $20M post-money in 2025. But zoom out to the top 5%, and it’s a different universe: seed valuations flirting with $100M, same stage, same label, wildly different expectations. This divergence explains a lot of today’s VC behavior. Fundraising is up again this year, roughly $110B in 2025, but the real momentum is happening earlier and looser, with pre-priced rounds now clearing $1B in deal volume per quarter. SAFEs have become the market’s favorite vehicle: fast, flexible, and just ambiguous enough to keep everyone optimistic. Pair that with valuation caps that stretch from “disciplined” to “vibes-based,” and you get a seed market where price discovery is more art than science. Layer in the social dynamics, and things get even spicier. As one viral VC Twitter thread put it: chasing hot logos may be bad for returns, but it’s often a good fit for fundraising. The Nash equilibrium? Everyone defects, bids up the same deals, and hopes access beats alpha. The alternative, a disciplined portfolio of weird, overlooked companies, might actually perform better, but it requires patience, conviction, and an LP that doesn’t just want the big-name brands. In 2025, seed investing wasn’t just about picking companies. It was about deciding which game you were playing.

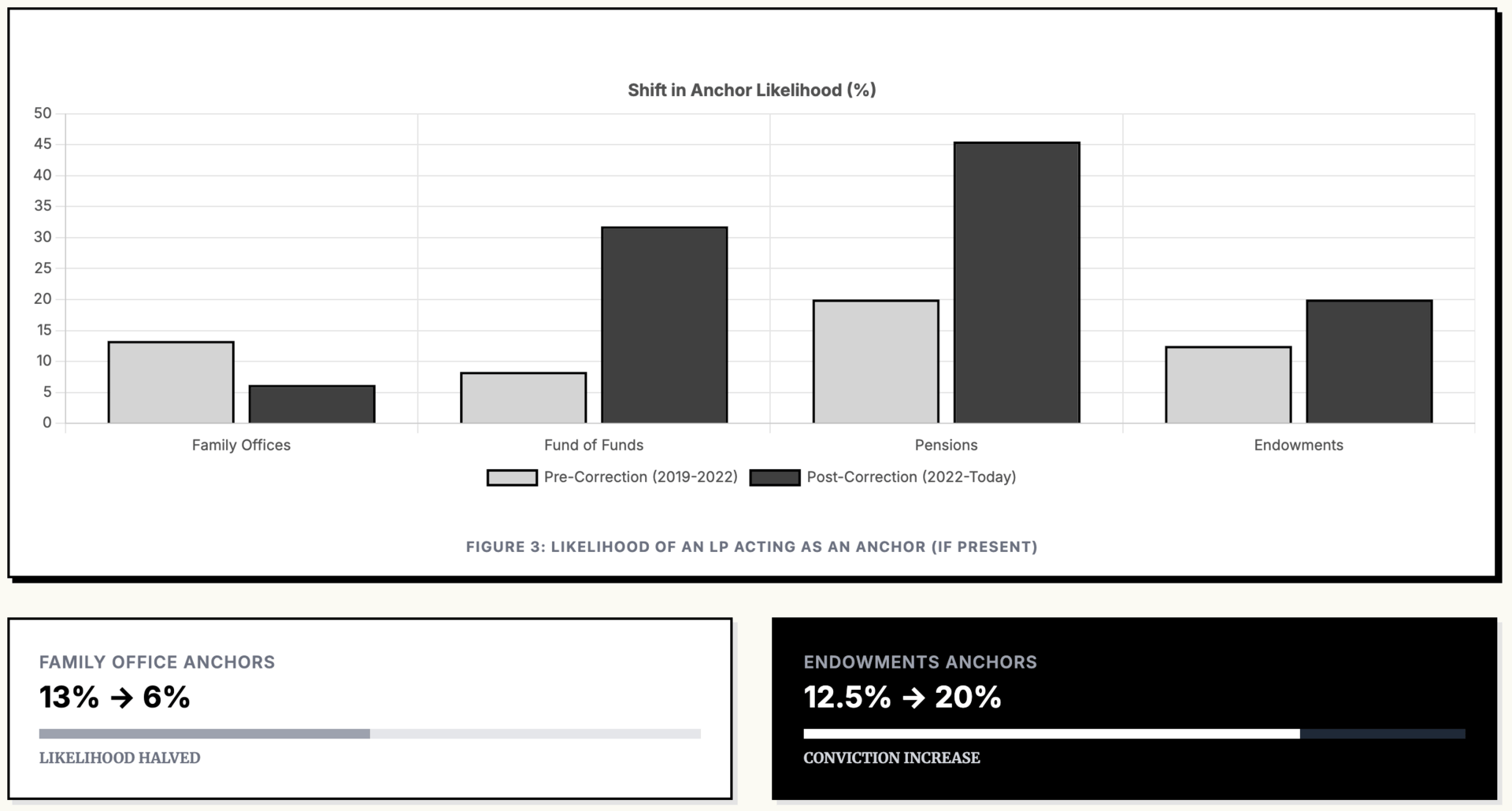

THE GREAT RECALIBRATION | The venture capital ecosystem is undergoing a profound structural shift, which Credistick is dubbing The Great Recalibration. Analysis of 48 funds from 30 firms, giving GPs a perspective on changes to the LP market for small VC firms. Fundraising difficulty spiked sharply compared to 2023 and 2024, with traditional sources like family offices and multi-stage VC funds pulling back, while institutional LPs (endowments, pensions, and fund-of-funds) quietly became the most dependable checks in the room. That reset is forcing smaller and emerging VC firms to compete differently. The old playbook of stitching together dozens of small checks is breaking down. There’s an LP preference for momentum, specialization, and proof of execution. LPs are underwriting velocity as much as vision, meaning early wins (or early misses) compound fast. A slow first close isn’t inconvenient; it can actively tax future fundraising. Zooming out, this fits neatly with what we’re seeing across venture more broadly. Capital is still flowing, especially at the early stage, but it’s flowing with intent. The Great Recalibration is separating funds with real edge from those riding narrative inertia. In 2025, raising a fund wasn’t about surviving the downturn. It was about demonstrating, early and clearly, why you deserve to exist in a more disciplined market.

Fundraising difficulty on a scale of 1-5 from 2023 to 2025

Shift in Anchor LP bases (2019-2022) and (2022-2025)

💰 Micro Trends

INSIDER TRADING | Bet on anything: TV, sports, elections. But what happens when the bettors are the ones holding the nonpublic information: employees, contractors, government officials, who know the outcome before the rest of us? In traditional markets, insider trading rules at least try to make that illegal; prediction markets don’t yet have rules. One Polymarket wallet, AlphaRaccoon, won on 22 out of 23 bets on Google’s 2025 Year in Search rankings, turning about $10,000 into roughly $1M. This week, a wallet quietly piled about $35,000 into Maduro/Venezuela attack markets hours before any public news, then sat on approximately $400,000 in profit once news broke and the internet caught up. There’s been an influx of these types of accounts on Polymarket, with new wallets dropping five-figure first entries, hyper-focused on a single market. Prediction markets are supposed to be truth machines, with prices as probabilities, refined by people with skin in the game. But when insiders can repeatedly monetize information only they have, everyone else is just providing them exit liquidity. Polymarket has gone from a CFTC enforcement action and a forced wind-down to an $8B valuation in three years, which feels exactly like the trajectory you’d expect from a founder who was emailing regulators about prediction markets as a kid. 📈

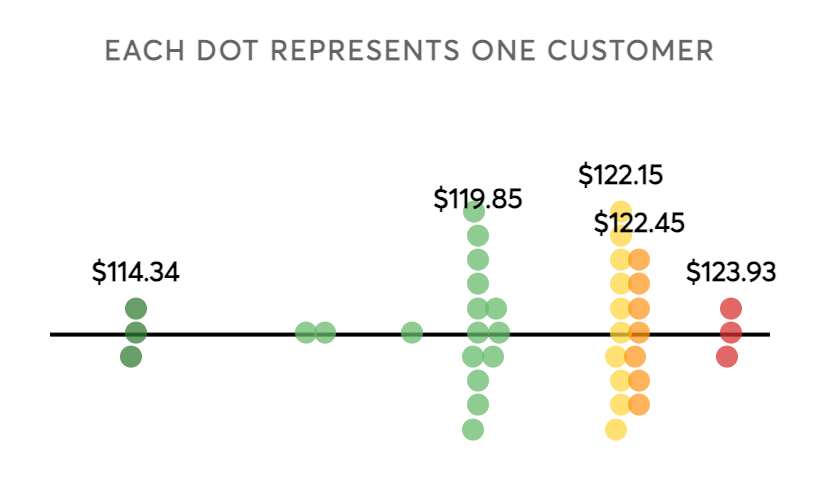

INSTACART ECONOMICS | Many Instacart shoppers think they’re just ordering milk and eggs, but not all products are priced equally… This month, Consumer Reports conducted a study where 39 volunteers ordered the same 20-item grocery basket from a Safeway in Seattle and took screenshots of their totals. The result: five different prices for the same food. Identical carts ranged from $114.34 to $123.93, a nearly $10 swing, and only 8% of shoppers landed the cheapest option. Same groceries, same store, same day… very different outcomes. 🛒 After acquiring AI pricing startup Eversight in 2022, Instacart began offering retailers software designed to “optimize” prices by dynamically adjusting what different customers see. The company says the tech can boost grocery sales by 1–3% and increase incremental margins by 2–5%. Translation: a few extra dollars here and there, multiplied across millions of carts, adds up fast. For shoppers, though, it raises an uncomfortable question: when you check out on Instacart, are you getting the price or just your price? A week after the Consumer Reports study was published, Instacart just hit the kill switch on its AI pricing experiments, after publishing a handful of blog posts and “fact sheets” about its pricing practices. It's immediately discontinuing its Eversight technology that allowed retailers to run dynamic pricing tests.

📰 Heartland Headline of the Month

The IO2026 Summit is bringing together entrepreneurs, investors, founders, and innovators on April 13th at the Sheldon Museum of Art in Lincoln, Nebraska.

Since 2017, InsideOutside has hosted the IOSummit to invite innovators and entrepreneurs in the Middle of America to converge and highlight that Innovation is everywhere.

Learn more about the summit, passes, and what to expect below ⤵️ 🚀

💰 Deals Outside Main Hubs

Not many rounds this month, but November was the month of the Series A in the heartland!

Check out the 223 flyover deals for over $3.3B in funding we tracked here; deals were up by 16% but total funding down by 5%, indicating more early-stage deals.

Chicago-based startups closed a handful of rounds this month

Architect raised a $35M Series A

Amphix Bio raised $12.5M Seed

Auxira Health closed a $7.8M Seed

Babbl Labs wrapped a $1M Seed

Vyriad closed a $25M Series B based in Rochester, MN

Champ closed a $55M Series C led by Point 72

Ypsilanti, Michigan-based LuxWall raised a $77M Series C with participation from Kholsa Ventures

Alphyn Biologics, based in Cincinnati, wrapped a $25M Series B

Med-device company RoddyMedical closed a $5M Series A

Fargo-based DetectAuto closed a $2.9M Seed Round

🐮 Middle America vs. National Macro Trends

Unemployment in Missouri stayed steady this month at 4.1%, and the National Average did as well at 4.3% ✅

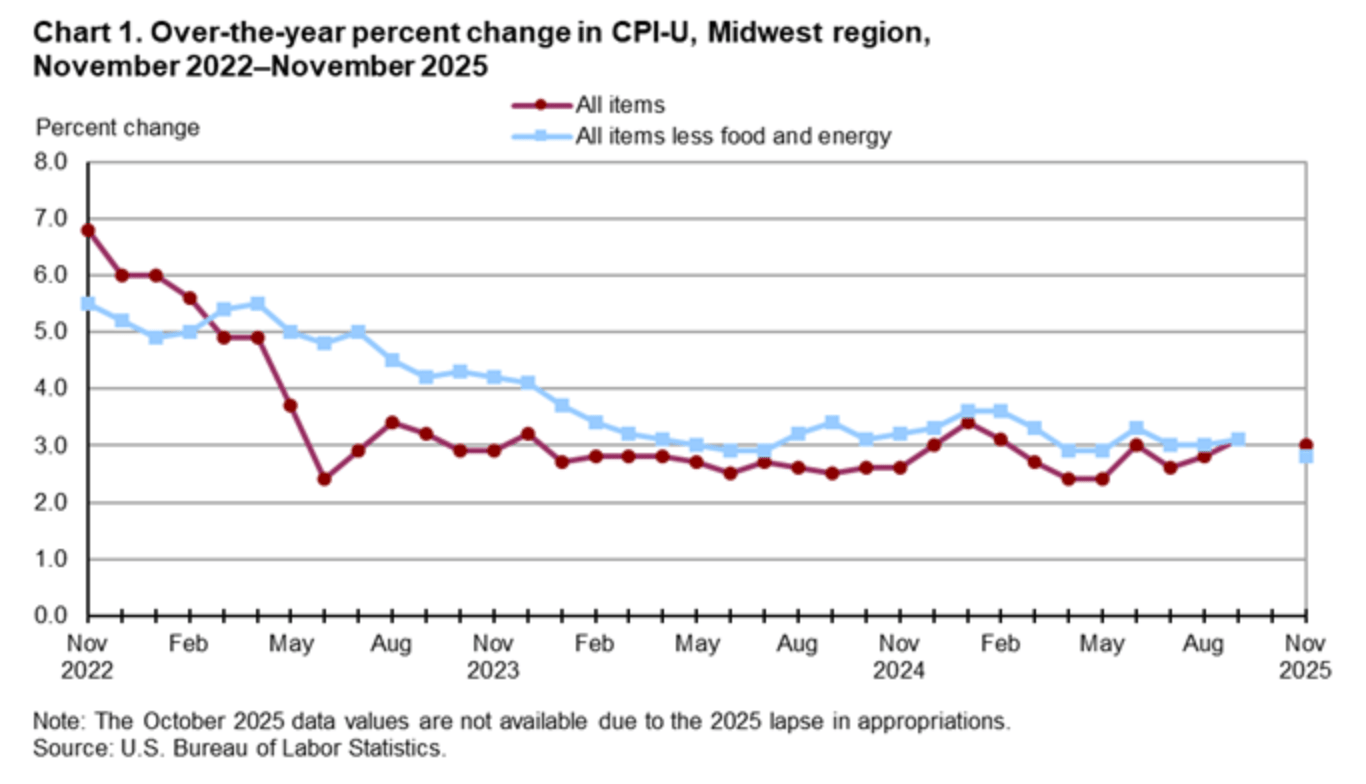

The Midwest Consumer Price Index stayed steady this month at around 3.0%, while the national rate is up 3% on the year ✅

🧠 This Month's Recommendations

📚 What We’re Reading

🎧 What We’re Listening To

From oil & gas spreadsheets to a soda giant to a $2B exit [38 min]

Uncapped #37 with Saam Motamedi from Greylock Partners [50 min]

Making complex ideas accessible on Think Fast Talk Smart [14 min]

📆 What We’re Doing

Gearing up for a jam-packed 2026 full of events, dinners, and summits hosted by Redbud (stay tuned)

🪝Under the Radar Picks of the Month

🚀 Redbud Highlights

We took a look back on 2025 to recap the highlights across our firm, portfolio, and communities. Check it out below ⤵️

🛠️ Our Favorite Startup Resources

If Morning Brew’s CEO Alex Lieberman was planning a 12-month, weekly entrepreneurship class, here's how it'd go...

Actually good fundraising advice straight from a founder

The only market sizing guide founders will ever need

Need some examples? Check out these 50 pitch deck examples from successful fintech startups

Thinking of raising some capital? Here’s the Due Diligence Checklist every founder should see 👀

Brian Chesky on when to hire 🧍🏼♀️

Get started to build an outbound sales motion with these 130 SaaS Cold Email Templates

🤖 Why code is no longer a moat

A list of low/no code tools to get your company off the ground 🚀

Marc Andreessen on how to hire the best people

The complete guide on How to Interview and Hire ML/AI Engineers (one of our favorite reads on hiring out there)

One of the largest VC lists with over 18k investors 🫰

Founder who 120 VCs—he closed $2.7M in 5 weeks with demand for $5M+. Here's his step-by-step guide to close a round. 💰

📊 All-In-One Startup Metrics Guide - What to track, when and why

Resource page for founders we made here 📒

The information provided in this newsletter is intended for general understanding and educational purposes only, not as a guide to investment decisions. The authors, publishers, and distributors of this newsletter are not licensed financial advisors and are not providing financial advice or investment advisory services.s