A Note From the Redbud VC Team

If November felt like someone hit “shuffle” on the entire economy, that’s because they kind of did. The 43-day government shutdown finally ended, AI models began leapfrogging each other hourly, and consumers spent on Black Friday as if inflation were just a rumor ($11.8B online in a single day). Google hit a record high stock price off the new Gemini model, xAI is somehow raising at a $230B valuation while burning billions on GPUs, and AWS announced a 5,500-km undersea cable because apparently the future needs more ocean plumbing than office parks. Venture operated in a very different gear: fundraising slowed, close times stretched, and seed rounds at the top end swelled to $40M avg. valuations pre-as-consensus crowded into the same handful of companies. If you’re building something that can command conviction, not consensus, pitch us here. ⬅️

Redbud VC invests $250k-$500k in early-stage tech founders. We bring monthly Redbud VC, tech, and economics updates. - We've filtered thousands of sources for our 15k readers, so you don't have to. Enjoy 🥂

A founder moved to SF, and his startup idea was to create an app that helps you find affordable housing. He pivoted on day one. 🏡

🔥 Burning question of the month 🔥

Most likely outcome high valuations have on the market?

📈 Macro Trend Report

AI | Google is having the kind of late-innings comeback most incumbents only dream about: Alphabet just hit a record close at $299.66 last week, fueled by the blockbuster debut of Gemini 3, its new flagship AI model that’s winning over analysts, leaderboards, and even Sam Altman, who now says “OpenAI is playing catch-up.” The company rolled out a 30x more power-efficient TPU, extended its ad machine into AI Mode, and topped it off with a stellar earnings beat, all while Waymo quietly outboxed Tesla in the robotaxi ring. Early Gemini reviews describe a step-change in reasoning and multimodal performance. Marc Benioff even tweeted, “I’m not going back,” though researchers note it can still hallucinate at the edges of its knowledge. Google has now taken the lead in the AI race. 🥇 While Google is arguably in the lead, AI valuations are still reading more like the GDP figures of small nations. xAI is reportedly seeking $15 billion at a $230 billion valuation, despite racing to finish its colossal Colossus 2 data center and needing an additional $18 billion to buy 300,000 more Nvidia GPUs, all while Grok trails the field with just 64M monthly users compared to ChatGPT’s 800M weekly. Meanwhile, the month’s most circular deal, $30 billion passed between Nvidia, Microsoft, and Anthropic, catapulted Anthropic’s valuation to roughly $350 billion, leapfrogging OpenAI’s last reported mark. Even newer entrants like Mira Murati’s Thinking Machines are “eyeing” $50 billion, according to Bloomberg.

FASTNET | AWS’s newly announced Fastnet subsea cable is the latest reminder that while everyone is busy debating model weights and land-based data centers, the real backbone of the AI era is still sitting quietly on the ocean floor. 🌊Stretching 5,500 kilometers from Maryland to County Cork and slated to go live in 2028, Fastnet adds a fresh transatlantic route with entirely new landing points, critical redundancy for a world where undersea cables handle 99% of all international internet traffic. It’s also AWS’s most ambitious subsea investment yet, contributing to the roughly 30,000 kilometers of fiber projects Amazon has in development and plugging into a global network that already exceeds 9M kilometers of terrestrial and subsea fiber combined. Zoom out, and Fastnet is just one thread in Big Tech’s increasingly sprawling underwater web. Microsoft and Meta lean on the 6,600-kilometer MAREA cable; Meta is chasing the crown for the world’s longest system with its 50,000-kilometer Project Waterworth; and Google leads the industry with access to 267,000 kilometers across 33 undersea projects, including Dunant, Curie, Grace Hopper, and Equiano. With 600+ active and planned submarine cables worldwide, these systems aren’t just infrastructure; they’re geopolitical assets, competitive moats, and the quiet enablers of the global AI boom. While data centers grab headlines, the race under the sea is just as fierce, and just as important

ECONOMY | The end of the 43-day government shutdown, the longest in U.S. history, finally brought federal workers back on the job and restored key services ranging from food assistance to air-traffic control, easing disruptions that have rippled through the economy for more than a month. With funding now extended through January 30, the focus shifts to what comes next: a dense month of economic signals, including private employment data, manufacturing reports, personal income and spending figures, and the delayed PCE Index, the Fed’s preferred inflation gauge. The Markets are gearing up for a big month with cautious optimism after a post-Thanksgiving rally in tech and retail, while investors await Jerome Powell’s upcoming remarks ahead of the year’s final rate decision from the Fed. There are rumors swirling that the new Fed chair will be named before Christmas, and we know the government will be open through then. Many are hoping that Jerome leaves with one small rate cut before his departure. 🎅🏼

VENTURE CAPITAL | Global VC fundraising is slogging through its third straight year of decline, with $82.6 billion raised across 849 funds through Q3 2025, well off the pace of 2024. The slowdown is basically the breakdown of the classic venture “flywheel”: fewer exits mean fewer LP distributions, which in turn mean fewer re-ups, which then suppresses new fund formation. Because VC relies on outlier returns to recycle capital back into the ecosystem, the current liquidity drought is the bottleneck through which everything else flows. Until IPO and M&A activity materially rebounds, fundraising will remain constrained and the extended friction is showing up in fund mechanics. Median time to close a fund has stretched to a record 17.4 months, up from 10.3 months in 2022. Longer closes mean more time spent selling to LPs and less spent supporting portfolio companies, adding operational drag to an already cautious market. Even as the fundraising landscape tightens, the composition of who can raise continues to tilt, slowly but meaningfully, toward more experienced GPs. In 2025, 49% of fund closures were led by seasoned managers, and although their share of capital dipped to 63% (from 72% in 2024), the broader trend since 2017 has favored established names. The nuance: LPs are sifting portfolios more aggressively, discounting inflated marks from the 2021–2022 vintage years and pushing GPs to price assets conservatively. Combined with the surge in VC secondaries, now institutionalizing as Wall Street banks snap up specialist firms, the market is recalibrating around liquidity, discipline, and durability.

SEED AT ANY PRICE? | As covered last month, seed investing in 2025 has become a game of “pay up or lose out.” Well, thanks to Pitchbook, we’ve got some data now! Top-decile rounds clearing at $40 million pre-money, nearly 3x the $15 million series median. These consensus deals compress ownership (about 20% versus the typical 25%) because investors aren’t competing on price; they’re competing for access. 🥊 Despite the froth, the historical data suggest the pricing isn’t irrational. Seed deals from 2006–2021 show broadly similar average MOICs across high- and low-priced rounds, but consensus deals carry a 10-point lower failure rate (29.5% vs. 39.4%) and produce more 10x+ outcomes, resulting in a stronger 35% median annualized return. In other words, investors aren’t necessarily overpaying; they’re buying smoother distributions and fewer zeros. But the strategy comes with a catch: time. IPO timelines have stretched from 7.5 to 9.4 years, raising the bar for sustaining historic returns. A consensus deal priced at today’s levels may need a $10B exit, not the old $3B, to deliver similar performance. Yet simulations show that selectively paying up for the highest-quality consensus rounds can outperform spray-and-pray approaches by a wide margin (median MOIC 3.8x vs. 1.7x). That dynamic is especially sharp in today’s AI-heavy market, where investors crowd into a narrow band of perceived winners while activity elsewhere remains subdued. Seed at any price isn’t a universal strategy, but it’s increasingly viewed as the cost of staying in the game.

💰 Micro Trends

SILVER TSUNAMI | The silver tsunami isn’t just ushering in a fresh wave of retirees eager to dominate weekday pickleball; it’s dragging the country’s most fragile safety net straight into a budgetary riptide. Today, about 56 million Americans aged 65+ receive benefits, and for retirees earning under $50,000 a year, Social Security is the primary source of income. As it stands today, Social Security is set to run dry in 2033, automatically cutting benefits to 77% of what was promised. Translation: the average monthly check drops from $2,008 to $1,546. and yet somehow, we’ve spent four decades nodding at the problem like, “Yes, interesting, someone should definitely handle that.” 🏃🏼♀️ The youngest boomers are 61, the oldest 79, and the ratio of workers paying into the system to retirees drawing from it has fallen from 3.4:1 in 2000 to 2.7:1 today, with a glidepath to 2.3:1 within the decade. Couple that with a U.S. fertility rate stuck at 1.62 births, far below the 2.1 needed for simple population replacement, and the imbalance looks less like a surprise and more like an expectation. The projected $350B shortfall in 2033 represents about 1.1% of GDP, a gap that experts say is mathematically solvable through various combinations of tax adjustments, benefit formula changes, or structural recalibrations. While we haven’t quite hit crisis or catastrophe, we do know that the situation is the predictable result of demographic aging and a pay-as-you-go system designed for a very different population curve.

BLACK FRIDAY | Black Friday was much better than expected as consumers are no longer busting down the doors at Best Buy but are still busting down the Shopify checkout screens! U.S. retail sales climbed 4.1%, outpacing last year’s 3.4%, while ecommerce did the heavy lifting: online sales surged 10.4%, in-store rose 1.7%, and Adobe clocked a record $11.8B in U.S. online spending (up 9.1% YoY). Globally, Salesforce tracked $79B in online purchases, with $18B coming from the U.S. AI-driven traffic to U.S. retail sites jumped a staggering 805% from last year. Turns out the robots aren’t taking our jobs yet, they’re just helping us select the best fleece-lined joggers at 2 a.m. A few big brands are right in the middle of the holiday spending crescendo, and one of them is Skims. Fresh off a Goldman Sachs Alternatives-led funding round that marked one of the largest U.S. consumer brand raises of the year, and valuing the brand at $5B. With expectations to top $1B in net sales in 2025, just six years post-launch, Skims enters the gifting season with tailwinds that Lululemon (still working on boosting its bottom line) could only dream of. Pair booming Black Friday demand with a brand scaling at this clip, and you get a neat snapshot of the U.S. consumer: equal parts resilient, comfort-driven, and clearly unbothered by adding one more stretchy, beige item to the cart. +🧦

📰 Headline of the Month

Brett Calhoun, General Partner at Redbud VC, was appointed to the board of Missouri Technology Corporation by Governor Kehoe.

💰 Deals Outside Main Hubs

Not many rounds this month, but November was the month of the Series A in the heartland!

Check out the 192 flyover deals for over $3.4B in funding we tracked here; deals were down by 18% and total funding down by 28% after a monster month in October.

Chicago-based Tradepost closed a $4.3M round led by a16z

Greymatter, a Chicago-based supplements brand, closed a $1.3M Seed round

RxSave Card closed a $1.5M Pre-Seed round led by Distributed Ventures

Michigan-based Modal Motors closed a $2M Seed round

Cincy-based Vurvey Labs raised an $8.5M Series A

Athian, an Indy-based agtech company, closed a $4M Series A

Chicago-based Abacus raised a $5M Series A

ElectronX closed a $30M Series A

🐮 Middle America vs. National Macro Trends

Unemployment in Missouri stayed steady this month at 4.1%, and the National Average did as well at 4.3% ✅

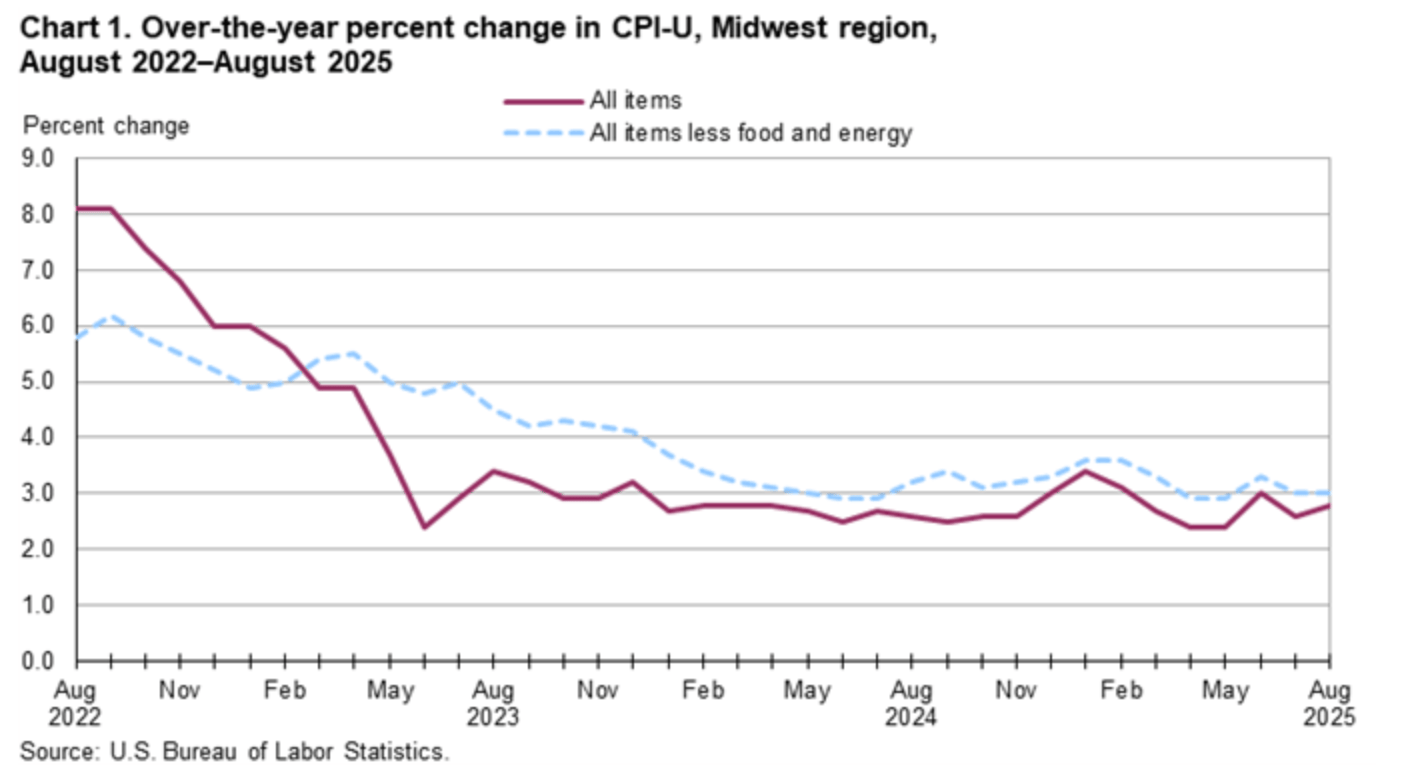

The Midwest Consumer Price Index rose slightly this month at 4.3%, while the national rate is up 2.8% on the year ✅

🧠 This Month's Recommendations

📚 What We’re Reading

🎧 What We’re Listening To

From bootstrapping to a global leader in mobility, the founder of Bolt on Crucible Moments [42 min]

The best consumer ideas were impossible until today [39 mins]

Uncapped #33 with Vlad Tenev from Robinhood [50 min]

📆 What We’re Doing

Main Street Summit was a hit. We moderated 3 panels, and welcomed 20+ Redbud VC founders to COMO. We had Breakfast at Brett’s, and brought the Redbud family of co-investors, founders, and LPs to the Bunker Club at Memorial Stadium (pictured below).

Attended Afore’s Pre-Seed Summit

We joined our friends from Flyover Capital at MidxMidwest in KC!

We hosted Builders & Backers in Boston to kick off Built Week alongside Suffolk Tech and C-Tech Club!

Gearing up for a jam-packed 2026 full of events, dinners, and summits hosted by Redbud (stay tuned)

Builders & Backers

Main Street Summit

🪝Under the Radar Picks of the Month

🚀 Redbud Highlights

Looking for a new role in 2026 👀

A handful of our portfolio companies are hiring — check out all of the open roles here:

Customer Success Manager - One Imaging

Salesforce & Systems Manager - One Imaging

VP, Growth Marketing - One Imaging

Data Analyst - One Imaging

Data Engineer - One Imaging

Founding Engineer - dScribeAI

Full Stack Engineer - One Imaging

Software Engineer, Data - Pave

Lead Engineer - One Imaging

Managed Care Contracting & Recruitment Manager - One Imaging

Senior Director Commercial Marketing - One Imaging

Sales Development Representative - Trestle

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

🛠️ Resources

If Morning Brew’s CEO Alex Lieberman was planning a 12-month, weekly entrepreneurship class, here's how it'd go...

Actually good fundraising advice straight from a founder

The only market sizing guide founders will ever need

Need some examples? Check out these 50 pitch deck examples from successful fintech startups

Thinking of raising some capital? Here’s the Due Diligence Checklist every founder should see 👀

Brian Chesky on when to hire 🧍🏼♀️

Get started to build an outbound sales motion with these 130 SaaS Cold Email Templates

🤖 Why code is no longer a moat

A list of low/no code tools to get your company off the ground 🚀

Marc Andreessen on how to hire the best people

The complete guide on How to Interview and Hire ML/AI Engineers (one of our favorite reads on hiring out there)

One of the largest VC lists with over 18k investors 🫰

Founder who 120 VCs—he closed $2.7M in 5 weeks with demand for $5M+. Here's his step-by-step guide to close a round. 💰

📊 All-In-One Startup Metrics Guide - What to track, when and why

Resource page for founders we made here 📒

The information provided in this newsletter is intended for general understanding and educational purposes only, not as a guide to investment decisions. The authors, publishers, and distributors of this newsletter are not licensed financial advisors and are not providing financial advice or investment advisory services.s