A Note From the Redbud VC Team

Bitcoin, Ethereum, blockchain, staking, Web3. If 5 words on one earnings call can nuke prediction markets in real time, it’s a pretty good metaphor for this month: knobs are getting twisted everywhere. 📊 AI now writes about half the internet (and Wikipedia’s traffic is feeling it), while Sam Altman finally said how much OpenAI’s revenue really is, it’s pennies compared to his growing AI infrastructure spend commitments. Meanwhile, the Fed eased rates again as Washington’s lights flickered, and tech CEOs are pushing to get those lights back on!💡 In VC, there’s one hot question atm: Seed at any price? Multistage funds have swarmed early rounds, valuations feel buoyant, and follow-ons are hitting faster and pricier. Pay up to own more sooner, or save dry powder for when ARR actually means something, but it may be too late? Translation: it’s a market of exceptions, not rules, and if you think you’re building something exceptional, pitch us here. ⬅️

Redbud VC invests $250k-$500k in early-stage tech founders. We bring monthly Redbud VC, tech, and economics updates. - We've filtered thousands of sources for our 15k readers, so you don't have to. Enjoy 🥂

Introducing Builders & Backers 🚀 🏗️

On November 17th, we’re teaming up with Suffolk Tech and C-Tech Club to host Builders & Backers, an invite-only event connecting founders, investors, and industry execs in the built environment. Raise, sell, invest, and buy all in one afternoon.

The afternoon agenda:

⚡ A panel discussion featuring industry experts

🤝 Curated 1:1 networking with founders, investors, and customers based on your goals: fundraising, pilots, selling, or hiring

📈 A room full of people who’ve shipped, scaled, and financed in this space

Space is limited, so if you’re in Boston for Built Week, we’d love to see you there.

What’s worse, a $10M on $150M pre-revenue Pre-Seed or an uncapped SAFE? We saw both last week. WE ARE SO BACK 😎

🔥 Burning question of the month 🔥

Who will come out of the AI boom as the biggest company?

📈 Macro Trend Report

AI | Sam Altman has rarely wanted to talk about revenue at OpenAI, repeatedly saying it’s one of the least interesting things about the company. This month, though, he tossed out a figure: at least $13 billion in annual revenue. Altman brushed off critics who express “breathless concerns” about revenue, many of whom, he implied, would be just as eager to buy OpenAI if given the chance. 💅🏽 Those questions will persist for Sam as long as revenue is >> spending. OpenAI’s committed AI-infrastructure spend reportedly totals around $1.4 trillion, equating to roughly 30 GW of data-center capacity, including announced deals with AMD, Broadcom, Nvidia, Oracle, and others. How he plans to finance this, Altman wouldn’t say, but private markets appear ready to fund OpenAI at almost any cost, bolstering its valuation and keeping the company out of public markets, even as Altman says an IPO is probably inevitable. On the public side, Nvidia surged again, becoming the first company in history to exceed $5 trillion in market capitalization, after crossing $4 trillion less than four months ago. The stock is up more than 1,500% over the past five years, propelling Jensen Huang into the ranks of the world’s ten richest people. Startup valuations are racing to keep pace: a handful of AI software companies are chasing Jensen, with Mercor reportedly quintupling its valuation to $10 billion in a $350 million Series C, just nine months after a $100 million Series B in February.

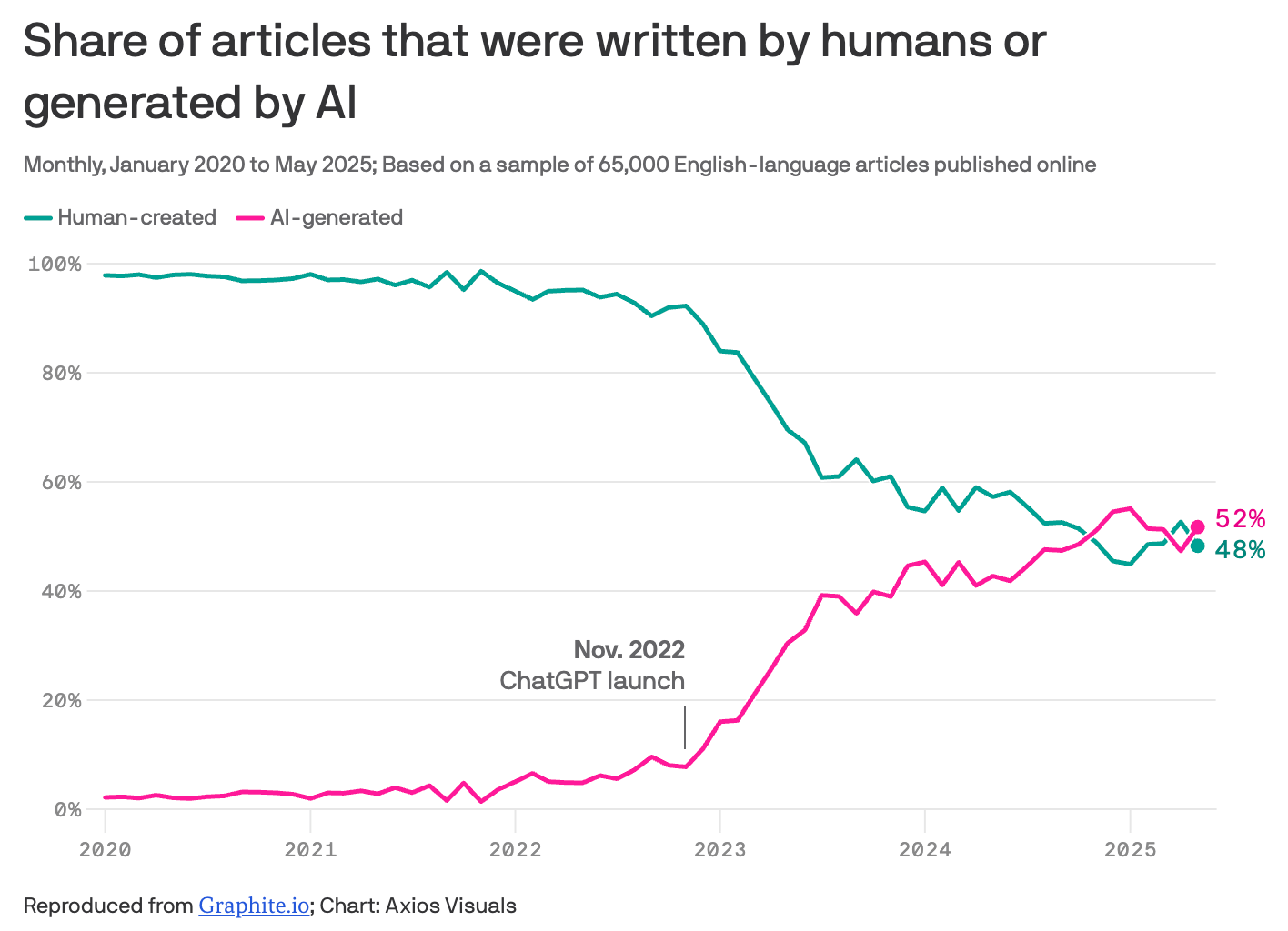

SLOP & SEARCH | Seeing more AI slop than usual lately? Well, it’s probably because the AI content takeover is roughly 50% complete. 🤖The share of AI-written articles on the internet has just surpassed that of human-written ones, making over 50% of content AI-generated. Graphite, the SEO firm, analyzed a random sample of 65,000 English-language articles published between 2020 and 2025 and found that 50%+ were generated with large language models. We’re not at full saturation yet, but a 2022 Europol report projected that 90% of online content would be AI-generated by 2026, so I guess we’ve got a year. 🤷♀️ One second-order effect of this AI influx, Wikipedia traffic is slipping. Human page views are down ~8% year over year, as AI search answers and social-media summaries satisfy user queries without a click-through. Marshall Miller of the Wikimedia Foundation warned that fewer visits could shrink the volunteer base that improves Wikipedia’s content and potentially dampen donor support. He argues that AI search and social platforms using Wikipedia data should actively drive more visitors back to the site to view content, rather than push them away. 🏃🏼♂️

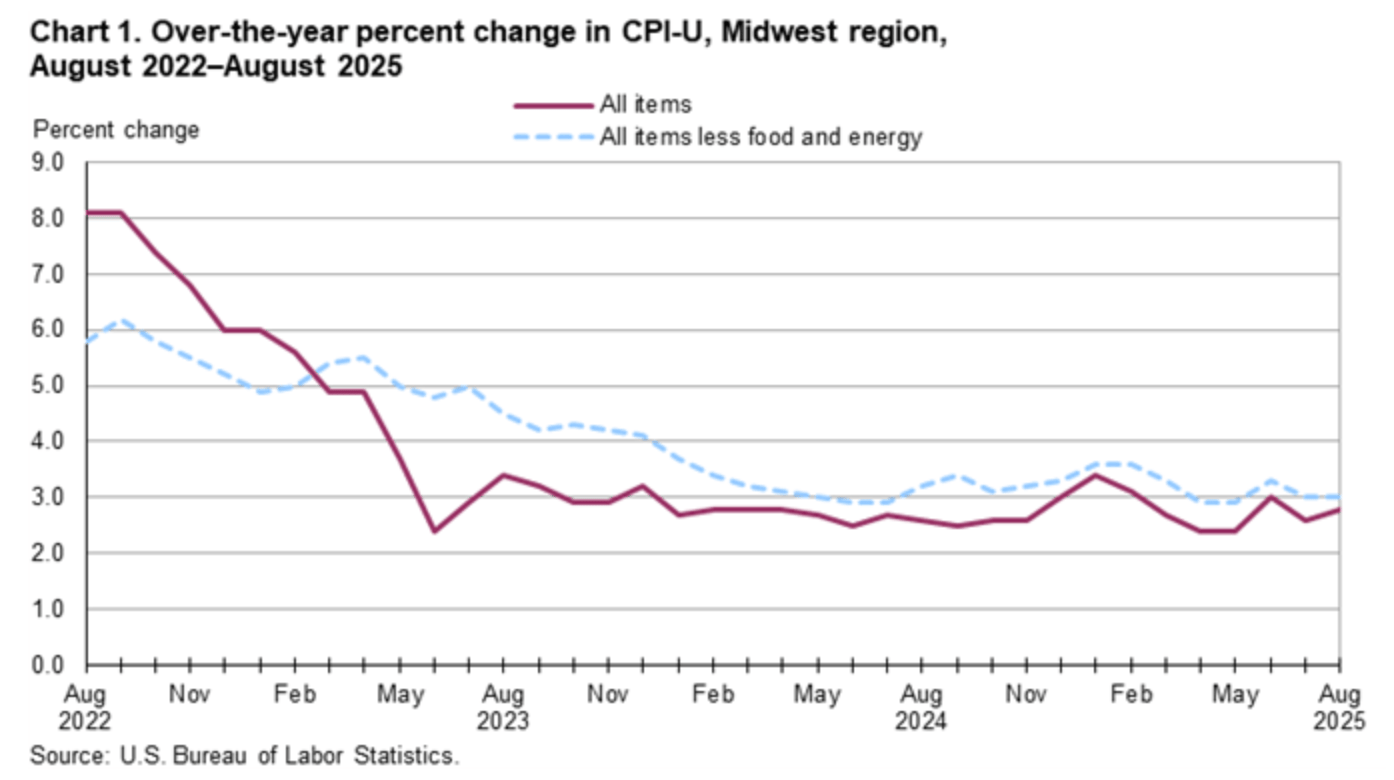

ECONOMY | All signs point to a slowdown as the Fed cut rates again this month and the federal government slid into a shutdown. 🛑The closure has now surpassed 30 days. As Americans press Congress to reopen, big-company CEOs are doing the same. The stakes are broad: ~42 million people risk losing SNAP benefits, and more than 65,000 SMBs that contract with the federal government face ~$3B in delayed spending each week. The FAA has shifted into crisis mode; at one point last weekend, ~80% of controllers were absent from New York–area facilities. With only a few more days, this shutdown could become the longest in modern U.S. history. Meanwhile, opportunists are circling: scammers are posing as government officials, and a furloughed IRS lawyer is living out his dream of being a hot dog vendor. 🌭 On monetary policy, the Fed lowered rates by 25 bps for the second time this year. The move wasn’t a surprise and reportedly passed on a 10–2 vote. Even before the shutdown, evidence had been building that downside risks to growth justified more aggressive rate cuts. Still, inflation remains above the 2% target; the latest CPI print put annual inflation around 3%, lifted by higher energy costs and categories affected by tariffs. As for the long term, visibility is limited. An economic downturn feels less like an “if” and more like a “when.” 😵💫

VENTURE CAPITAL | Seed at any price? That’s the question many fund managers and LPs are asking, on Twitter/X, to each other, and in private. Pre-seed and seed have traditionally been the sandbox for small or specialist firms writing early checks, taking on risk, and trying to make their own magic through mentorship and conviction. When those bets hit, the outlier returns offset high loss rates. But in the last 18–24 months, early-stage dynamics have shifted fast. Large multistage firms have moved earlier, leaning hard into seed. At the same time, companies are staying private longer, pushing realizations further out for seed managers and intensifying pressure to deliver timely DPI to LPs. The influx of deep-pocketed entrants has changed first-round mechanics: bigger checks, higher entry valuations, and thinner ownership. More capital is chasing the same early equity, forcing traditional seed managers to compete directly with the industry’s largest funds for allocation. Which begs the question: at what price do you write the check? As deals consolidate, it can feel like funding accrues to a narrow profile: repeat founders, “obvious” outliers, or companies sprinting from zero to $1M ARR in a quarter. But what about everything outside those boxes? Where are the less legible companies being built that may drive outlier returns later? That uncertainty is what many VCs are wrestling with now, especially as early-stage consolidation compounds.

SPRAY & PRAY | As Peter Walker at Carta says, Spray and Pray is everyone’s favorite debate. What makes the conversation different is the Seed consolidation detailed above. Over the last 18 months, the ground rules have shifted. Following on into your best companies has gotten harder; later rounds are arriving faster, sizing up, and stretching reserves, which compresses the window to press winners. At the same time, early ARR is a weaker signal; durability and quality are harder to underwrite, making it tougher for non–mega funds to lead the next round with conviction. Add pockets of price insensitivity, and the relative appeal of moving earlier (i.e., owning more at pre-seed/seed) has increased. Ultimately, concentration now demands more proactive reserves and real speed. Leo Polovets takes on his strategy @ Huma Venutres below ⤵️

1-1 Tactic Teardown Sessions From Senior Growth Team

First come, first served! Bring your goals and numbers. Our senior growth team will review them with you in a private session, highlight the highest-impact moves, and send you a simple plan to execute.

Limited spots available.

💰 Micro Trends

GLP-1 | It’s hard to dodge the celebrity chatter around Ozempic and its modern weight loss cousins. Goldman Sachs pegs the anti-obesity meds (AOM) market at about $6B annually this year and expects it to grow 16× to more than $100B by 2030, putting roughly 16% of Americans on some form of AOM. Brands are racing downstream to make these drugs as accessible to the consumer as possible. This month, Hims & Hers rolled out “GLP-1 microdosing,” doubling down on compounded takes on Novo Nordisk’s winners. Hims & Hers started selling compounded Wegovy last year, which earned them a friendly FDA letter about their marketing practices. 📩 Outside of the D2C players, Big Pharma wants a piece of the consumer pie without sacrificing margins. Eli Lilly cut a deal with Walmart to sell Zepbound at cash pay nationwide starting in November, priced at about $350 to $500 per month, compared with about $1,000 elsewhere. In Q2 2025, 35% of Zepbound prescriptions were already fulfilled through Lilly’s direct-to-consumer pharmacy “LillyDirect” making the Walmart partnership a natural expansion to bolster those prescriptions. Not to be left on the sidelines, Novo Nordisk inked a deal with Costco to set up its own cash-pay arrangement for Wegovy. Pharma is muscling to elbow out DTC copycats like Hims & Hers in the accessibility race, and consumers are happy to pay whatever price is lowest at the checkout line.

BAGS CHECKED | Southwest’s bags don’t fly free anymore, and yes, passengers hate it, but it did give Southwest its best quarter yet in revenue. The airline topped earnings and revenue expectations as newly introduced bag fees started doing exactly what they were designed to do, with demand firming in July and corporate travel improving from last quarter. Guidance was upbeat but sane: revenue per available seat mile is pegged to rise 1%–3% in Q4, while capacity grows about 6%, even as skeptics warn airlines may be adding seats faster than the economy can fill them. Southwest kept its full-year profit outlook intact—translation: monetization is finally pulling its weight, but the real trick will be growing without overstuffing the overhead bins. ✈️

PREDICTION TROLLS | “Bitcoin, Ethereum, blockchain, staking, Web3.” With that five-word volley, Coinbase CEO Brian Armstrong torched live prediction-market bets on what he would say on the company's Q3 earnings call into a master class on how trivially insider-controlled outcomes can be gamed. You can bet on anything now, from Fed moves, Taylor setlists, and CEO buzzwords, but when the resolution hinges on a handful of people holding a microphone, “wisdom of the crowd” morphs into “who feels like saying it.” Layer on crypto rails, patchwork state rules, and thin liquidity, and the edge isn’t math, it’s information. Fun spectacle? Totally. Reliable signal? Only until the next person on stage decides to troll the outcome. Thanks, Brian! 🙂

📰 Heartland Headline of the Month

This month, Arch Grants brought 19 startups to St. Louis and introduced three new Fellows to mentor founders, among them one of our portcos, Trestle!

Each company receives $75K (plus $25K for relocations), and 74% of this year's recipients are diverse teams!

Read more about the recipients below ⤵️

💰 Flyover Deals

Lots of solid Seeds were planted this October 🌱

Check out the 235 flyover deals for over $4.8B in funding we tracked here; deals were down by 4%, but total funding was up by 25%!!!!!!

Minnesota-based VentureMed Group closed a $28M Series C led by S3 Ventures

Stablecoin startup Coinflow raised a $25M Series A 🔐

Cleveland was killing it this month

Mediview XR closed a $24M Series A

Sonic Fire Tech closed a $3.5M Seed Round co-led by Third Sphere and Kholsa Ventures 🔥

Plastomics, a St. Louis-based Ag-tech company, closed a $5.8M round of funding 🚜

Chicago-based Tradepost closed a $4.6M Seed round

Bismarck-based Pavewise closed a $2.5M Seed Round led by C2 Ventures

🐮 Middle America vs. National Macro Trends

Unemployment in Missouri stayed steady this month at 4.1%, and the National Average did as well at 4.3% ✅

The Midwest Consumer Price Index rose slightly this month at 4.0%, while the national rate is up 2.8% on the year ✅

🧠 This Month's Recommendations

📚 What We’re Reading

The art of understanding what’s going on !! 🧠

LLM easy buttons and context rot

🎧 What We’re Listening To

Zipline’s Keller Clifton on pivoting from toy company to autonomous drone delivery system [45 min]

Uncapped #29 with Coatue’s Thomas Laffont [1 hr 2 min]

Alfred Lin on Sourcery on how one of the world’s most iconic venture funds, distributed over $43B to investors since 2020, and on what it’s like to be the best (so good they split the episode into two parts)

📆 What We’re Doing

Joined our friends at Cherub for a dinner with a select group of founders on their platform and a few Chic

ago-based investors & allocators. 🪽

Flew to SF to join the team at Afore for their Annual Pre-Seed Summit 🚀

Prepping for Main Street Summit, November 4-6th, and BuildersBackers, November 17th !!

MidxMidwest is also right around the corner, and we can’t wait to see some familiar faces in KC, November 12th & 13th.

🪝Under the Radar Picks of the Month

🚀 Redbud Highlights

Congrats to portfolio company OneImaging for closing their $31M Series A (in conjunction with the announcement of their $7M Seed Round). The round was led by Vy Capital, with participation from Aquiline, Sempervirens Venture Capital, XRC Ventures, Dylan Field, Balaji Srinivasan, Jon Oringer, and more.

By connecting people to a nationwide network of accredited imaging centers, the company delivers up to 80% cost savings while ensuring high-quality care and transparent pricing. OneImaging has grown 50x in less than three years, partners with Fortune 100 employers, and integrates with the largest commercial health plans to bring affordable imaging to millions

Read more about OneImaging and their plans for the fresh capital below ✨⤵️

🛠️ Resources

If Morning Brew’s CEO Alex Lieberman was planning a 12-month, weekly entrepreneurship class, here's how it'd go...

Actually good fundraising advice straight from a founder

The only market sizing guide founders will ever need

Need some examples? Check out these 50 pitch deck examples from successful fintech startups

Thinking of raising some capital? Here’s the Due Diligence Checklist every founder should see 👀

Brian Chesky on when to hire 🧍🏼♀️

Get started to build an outbound sales motion with these 130 SaaS Cold Email Templates

🤖 Why code is no longer a moat

A list of low/no code tools to get your company off the ground 🚀

Marc Andreessen on how to hire the best people

The complete guide on How to Interview and Hire ML/AI Engineers (one of our favorite reads on hiring out there)

One of the largest VC lists with over 18k investors 🫰

Founder who 120 VCs—he closed $2.7M in 5 weeks with demand for $5M+. Here's his step-by-step guide to close a round. 💰

📊 All-In-One Startup Metrics Guide - What to track, when and why

Resource page for founders we made here 📒

The information provided in this newsletter is intended for general understanding and educational purposes only, not as a guide to investment decisions. The authors, publishers, and distributors of this newsletter are not licensed financial advisors and are not providing financial advice or investment advisory services.s