A Note From the Redbud VC Team

September has been a month of contradictions: deal dollars are climbing while deal volume keeps shrinking, Build-A-Bear is running laps around Nvidia, and the Midwest is quietly minting unicorns and mega-rounds like it’s coastal business as usual. 👀 Zero Hash (Chicago) pulled in a $104M Series D at a $1B valuation, Des Moines-based Brale bagged a $30M Seed Round led by Lightspeed (you read that right), and Detroit’s Knox Metals closed a healthy post-YC demo day round—all proof that big checks are still getting written, even if fewer deals make the tape. Meanwhile, five new AI data center projects broke ground across the U.S., the Fed cut rates as unemployment hit a four-year high, and everyone’s bracing for the “great lock-in” from September to December, those months when founders, funds, and big tech try to sprint, focus, and plan for the new year all at once. Nothing is quite what it seems, but one thing’s clear: if you’re out there moving, you’re the one getting things done. So if you’re locked in, let us know here ⬅️🔓

Redbud VC invests monetary ($250k-$500k) and social capital in early-stage tech founders. We bring monthly Redbud VC, tech, and economics updates. - We've filtered thousands of sources for our 15k readers, so you don't have to. Enjoy 🥂

Introducing Builders & Backers 🚀 🏗️

On November 17th, we’re teaming up with Suffolk Tech and C-Tech Club to host Builders & Backers, an invite-only event connecting founders, investors, and industry execs in the built environment. Raise, sell, invest, and buy all in one afternoon.

The afternoon agenda:

⚡ A panel discussion featuring industry experts

🤝 Curated 1:1 networking with founders, investors, and customers based on your goals: fundraising, pilots, selling, or hiring

📈 A room full of people who’ve shipped, scaled, and financed in this space

Space is limited, so if you’re in Boston for Built Week, we’d love to see you there.

How’s everyone’s great lock-in going?

🔥 Burning question of the month 🔥

At what point does valuation break the venture model?

📈 Macro Trend Report

AI | OpenAI recently shared its performance metrics for the first half of the year, clocking a 16% jump in sales compared to ALL of 2024. The company is now pulling in over $1 billion in monthly revenue and seems on track to hit $13 billion in revenue alongside $8.5 billion in cash burn for 2025. That said, with plans for significant GPU investments and ramped-up data center builds over the next five years, some projections suggest their burn could climb as high as $115 billion by 2029, making the 2025 figure feel like pennies…On another note, Elon Musk has filed yet another lawsuit against OpenAI, this time in federal court in North Carolina. He’s accusing the company of luring away key talent, including a senior finance executive and an engineer, allegedly in an effort to obtain trade secrets. While it’s still unclear if these hires actually joined OpenAI, Elon claims they were approached to share proprietary information. This case adds to the growing list of legal disputes Musk has initiated against Sam over the past couple of years. An Open AI spokesperson shared with Sherwood News, “This new lawsuit is the latest chapter in Mr Musk’s ongoing harassment. We have no tolerance for any breaches of confidentiality, nor any interest in trade secrets from other labs." Yikes Finally, A new OpenAI study was released this month, marking the largest study to date on consumer ChatGPT usage. The study was conducted with Harvard economist David Deming and analyzed 1.5 million conversations. The findings?

Women make up >50% of users, closing what used to be a glaring gender gap.

Adoption is growing fastest in low- and middle-income countries, where usage is 4x higher than in wealthier nations.

About 30% of usage is work-related, and 70% rest is personal life.

Prompts are most often related to handling everyday tasks, such as drafting an email, finding information, or asking for advice.

INFRASTRUCTURE CONSTRUCTION | Every month, we typically see new AI model launches from the major players. However, September took a different turn with big launches about✨AI data center construction✨! Oracle shared more details about its $500 billion deal with OpenAI, sending its stock prices soaring. The project, named Stargate, includes five new sites: two in Texas, one in New Mexico, one in Ohio, and another in an unspecified Midwest location (maybe Missouri)? 👀 Meanwhile, Nvidia announced a partnership with OpenAI to invest $100 billion in a 10 GB data center buildout. Although the exact location is unknown, Nvidia CEO Jensen Huang told CNBC the project is "the largest AI infrastructure project in history." Meta also shared its ambitious plans to construct Hyperion, a city-sized data center in Richland Parish, Louisiana, scaling up to 5 gigawatts, alongside Prometheus, a 1-gigawatt data center in New Albany, Ohio. In the sea of announcements, xAI has already broken ground on Colossus I, completing its first center in South Memphis, Tennessee, in just 122 days. Colossus I was the first to achieve one megawatt of computing power, and xAI is now working on Colossus II in the Memphis area, which will provide an additional gigawatt of power. That said, opinions on this rapid expansion vary widely, depending on who you ask! Some see it as an excessive waste of money, while others argue it’s not happening quickly enough. Data center construction spending in July alone reached an annualized rate of $41 billion, surpassing the total construction costs of all private office spaces in the U.S., a 2,200% increase since July 2014.

JOBS | Jerome Powell recently graced TV screens and news feeds across America as the Federal Reserve announced a quarter-point rate cut earlier this month (that’s 25 bps, if you prefer to “basis points”) 😏. They also signaled the possibility of two additional cuts by year-end, primarily citing growing concerns over the state of the labor market. The Fed described the move as a precautionary step to mitigate risks tied to a slowing job market and to stave off potential recessionary pressures. The August jobs report showed weaker-than-expected growth, with only 22,000 jobs added and unemployment inching up to 4.3%, the highest level in nearly four years (see our Middle America vs. National Macro Trends where we track unemployment #’s every month!) In response, the Fed is opting for what it sees as a more proactive strategy. One bright spot? Healthcare. The Bureau of Labor Statistics projects healthcare support roles to expand by 12.4% over the next decade, citing the sector as a key driver of job growth through 2034.

VENTURE CAPITAL | No new news here…the Venture Market remains as unbalanced as ever. Deal dollars have increased significantly in the first three quarters of 2025, primarily driven by AI, compared to the same period in 2024. However, the number of deals has declined. According to PitchBook, there has been a 42.8% growth in deal dollars in 2025, accompanied by a 31.43% drop in deal volume. Basically, fewer companies are receiving larger investments, creating a wider gap for early-stage companies, those in overlooked regions, or those lacking AI traction, making them less appealing to investors. The lopsided Venture Market is having ripple effects on upstream private and public markets. The global M&A market has seen a 32% rise in deal dollars but a 9% decline in deal volume—mirroring the venture market. This type of deal environment benefits larger, multi-stage firms, but doesn’t necessarily guarantee higher returns on investment. But still the pressure is on to generate returns on the significant capital funneled into a smaller pool of companies.

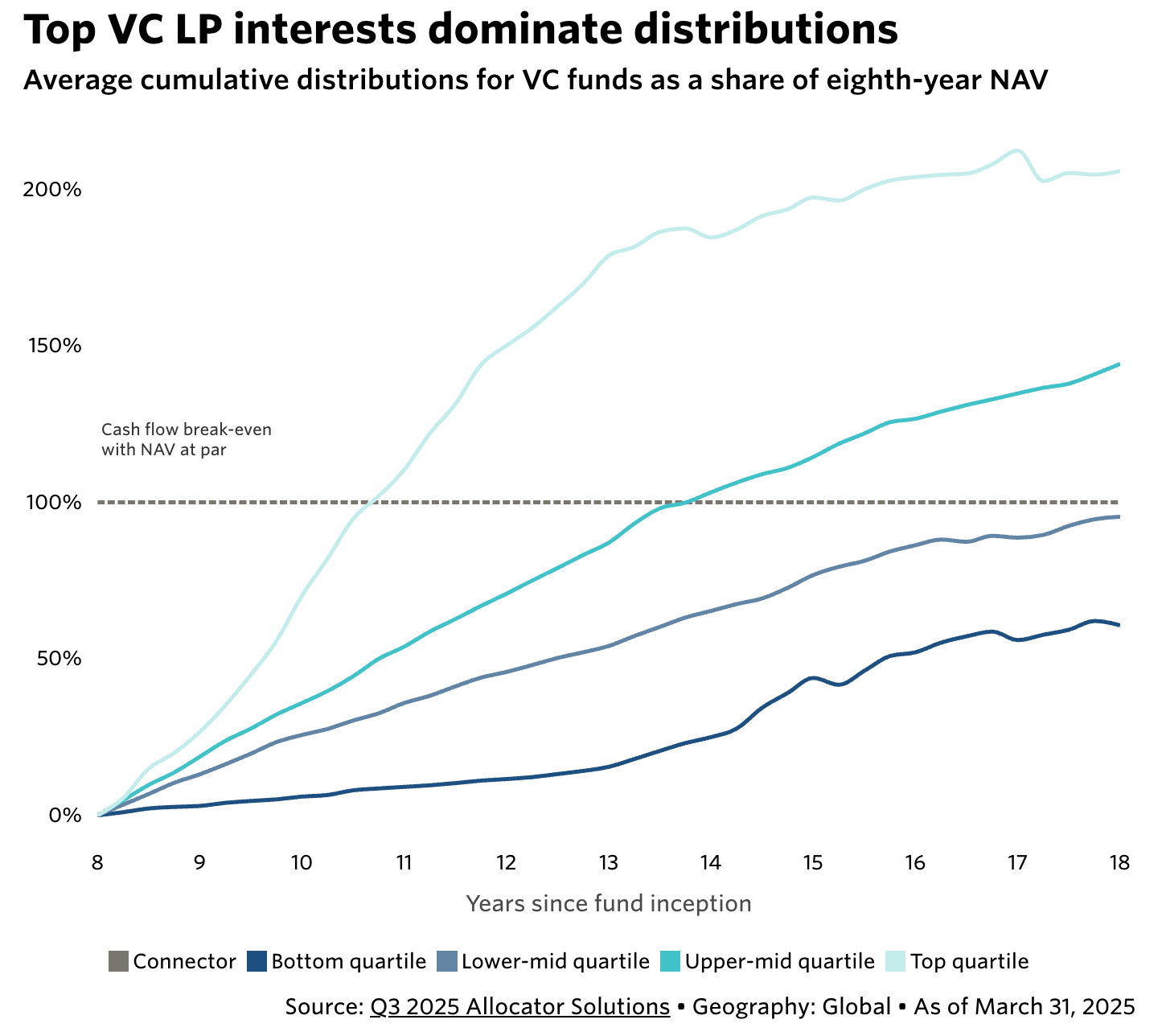

LIQUIDITY | LPs have been hungry for liquidity, and Q3 finally delivered some movement! Secondary sales of fund stakes reached all-time highs as underperforming funds (and ample patient capital) sought an exit. For perspective: 2024 set a record with $160B in secondary sales, and 2025 is already on track to beat it. The driver is clear, venture outcomes are looking more volatile, and LPs are leaning into more conservative ways to rebalance. Outside of just secondaries, Q3 also gave us 13 U.S. VC-backed IPOs, totaling $36.4B in exit value, up a casual 2,861% from last year. 💅🏽 That doesn’t mean the floodgates are open, but it’s a notable change in the tape. And there’s more in the queue: Wealthfront, with $88B in AUM, just filed for an IPO, and Jennifer Garner’s Once Upon a Farm is targeting a $1B debut. Liquidity is still scarce, but at least the headlines are finally moving in the right direction.

Build your investor pipeline with the comprehensive VC List we crafted for all founders

💰 Micro Trends

30u30 | Charlie Javice, founder of Frank, was sentenced this week to 7 years in prison for defrauding JPMorgan. The bank acquired her startup in 2021 for $175 million under the impression that it served over 5 million students at 6,000 colleges; in reality, the customer base was closer to 300,000, and the rest was fabricated. JPMorgan missed it in diligence, Javice was arrested in March 2023, and now she’ll serve time and pay ~$390M in restitution. She joins a growing club of fallen Forbes 30u30 alums, including Sam Bankman-Fried and Elizabeth Holmes, whose résumés read more like Netflix docuseries pitches than career highlights. And while not every headline is federal-court material, the brand isn’t exactly aging gracefully: a founder’s viral tweet this month (1.5M views) described being asked to sign a non-disparagement clause by their own Forbes 30u30 co-founder, prompting YC’s Garry Tan to say there will be consequences for those bullying the founder who left the company. Which begs the question: has the fraud and drama cheapened the status of making the list, or does the Forbes 30 Under 30 badge still carry the same weight it once did?

BULLISH ON BEAR | Look at any index fund right now and you’ll probably see the usual suspects, Apple, Palantir, a sprinkle of Nvidia, but lurking in the mix is an unlikely contender: Build-A-Bear. Yes, the mall staple of childhood has quietly turned into a market darling. Its stock (NYSE: BBW) is up nearly 2,000% over the past five years, doubled in the past year alone, and is already +66% YTD, outpacing some of the biggest names in AI and tech. To put that in perspective: a $100 bet on Build-A-Bear at the start of 2021 would now be worth ~$1,600, about $200 more than if you invested the same amount in Nvidia at the same time. Powering the run is surprisingly, Adults. Analysts estimate that 40% of Build-a-Bears sales now come from “grown-ups,” the same trend that powered Lego’s $4B in sales last year, with adult-targeted sets like their botanical collection and Formula 1 cars. China’s Pop Mart has ridden the same wave of collectible-plush virality with its Labubus, rocketing 350% since its IPO and reaching a $44.2 billion valuation, which is larger than the combined valuations of the next 3 largest toy makers: Hasbro, Mattel, and Sanrio. Pop Mart stock is up 189% this year alone. All in all, we’re bullish on bear. 🧸 (Check out Morning Brew’s Build-a-Bear named Bill Ackman here)

📰 Heartland Headline of the Month

Any founder or investor who is raising right now knows that it’s tough out there ☹

Despite a difficult fundraising environment, The O.H.I.O Fund, an Ohio-focused investment fund, has raised nearly $240M in its first year! The firm has already made 19 investments with check sizes ranging from $1 million to $70 million, including in a Cleveland-area manufacturer of cellular semiconductor modules, several large plots of land, and a dog food maker.

Congrats to the O.H.I.O Fund team and their new portcos 🥳

💰 Flyover Deals

A handful of big rounds this month, and a few new Midwest unicorns join the club 🚀

Check out the 246 flyover deals for over $3.8B in funding we tracked here; deals were down by 4%, but total funding was up by 65%!!!!!!

Chicago-based companies closed rounds big and small this month!

zerohash raised a $104M Series D, minting it the newest crypto infrastructure unicorn 🦄

Kin Insurance raised a $50M Series E at a $2B valuation

Madison Scientific finished an $10M oversubscribed Seed Round

SafeHill emerged from Stealth with a $2.6M Pre-Seed

Loretta, a Detroit-based ed-tech company, closed a $1M Pre-Seed

Cleveland-based Splash Financial raised a $70M Series C 💰

Detroit-based Nox Metals closed their post-YC Demo day round, totaling $4.6M with participation from Precursor and Mana Ventures

Lots of big wins for Missouri-based companies 🐯

Kansas City-based BaaS provider Lead closed a $70M Series B led by a16z

Trially wrapped a $4.7M Seed Round 💊

Platte-city-based LPOXY Therapeutics raised a $28M Series A

Saint Peter-based BizzyCar closed a $20M Series B

St. Louis-based Sweet Spot raised a $1M Pre-Seed

🐮 Middle America vs. National Macro Trends

Unemployment in Missouri was once again on the rise this month to 4.1%, while the National Average also rose to 4.3% ✅

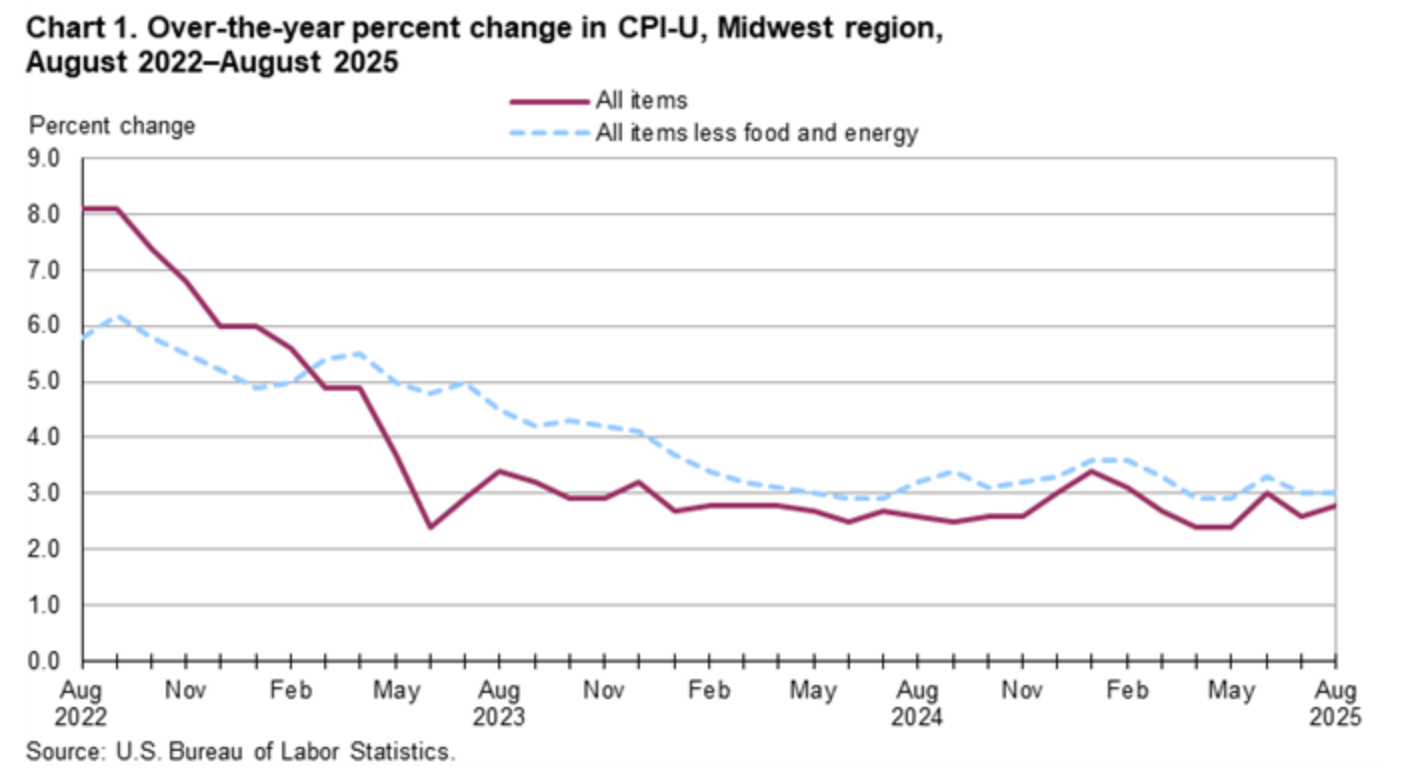

The Midwest Consumer Price Index rose slightly this month at 4.0%, while the national rate is up 2.8% on the year ✅

🧠 This Month's Recommendations

📚 What We’re Reading

Inflection points → first order → aftershock

Building big companies in non-obvious markets part II @Rabacap

Big funds, small funds, and the changing tide 🌊

Curious Times — From the Information to the Question Age ❓

🎧 What We’re Listening To

#599 Sam Altman on This Past Weekend [1hr 33min]

Lessons across 400 portfolio companies with Precursor’s Charles Hudson [37 min]

Amplify’s founders Sunil Dhaliwal and Mike Dauber on their journey from a solo GP experiment to a $900M platform [41 min]

📆 What We’re Doing

Made a quick trip to Austin for our friends at Drive Capital’s TAM event, as well as Drive’s End of Summer Showcase at their Chicago Office! 🚗

We headed to NYC for a Female Founders & Investors Dinner hosted by Rho & Capital Collective and made a few stops with some portfolio companies & co-investors.

Joined our friends at Chingona Ventures to celebrate Hispanic Heritage Month with over 100 founders, investors, and builders at the Micheline Guide featured Taqueria Chingon 🌮

Prepping for Main Street Summit, November 4-6th, and BuildersBackers, November 17th !!

🪝Under the Radar Picks of the Month

🚀 Redbud Highlights

Congrats to portfolio company Trially on closing their $4.7M Seed Round led by our friends at Flyover Capital, with participation from Alpaca, Atria, Blu Ventures, Looking Glass Capital, Redbud, The Council, and Gaingels.

With the new funding, Trially will accelerate the adoption of its platform across research sites, pharmaceutical sponsors, CROs, and physician networks, ensuring sponsors can avoid costly delays and patients can access life-saving treatments when it matters most.

Read more about Trailly and their plans for “Margo” below ✨⤵️

It's not you, it’s your tax tools

Tax teams are stretched thin and spreadsheets aren’t cutting it. This guide helps you figure out what to look for in tax software that saves time, cuts risk, and keeps you ahead of reporting demands.

🛠️ Resources

If Morning Brew’s CEO Alex Lieberman was planning a 12-month, weekly entrepreneurship class, here's how it'd go...

Actually good fundraising advice straight from a founder

The only market sizing guide founders will ever need

Need some examples? Check out these 50 pitch deck examples from successful fintech startups

Thinking of raising some capital? Here’s the Due Diligence Checklist every founder should see 👀

Brian Chesky on when to hire 🧍🏼♀️

Get started to build an outbound sales motion with these 130 SaaS Cold Email Templates

🤖 Why code is no longer a moat

A list of low/no code tools to get your company off the ground 🚀

Marc Andreessen on how to hire the best people

The complete guide on How to Interview and Hire ML/AI Engineers (one of our favorite reads on hiring out there)

One of the largest VC lists with over 18k investors 🫰

Founder who 120 VCs—he closed $2.7M in 5 weeks with demand for $5M+. Here's his step-by-step guide to close a round. 💰

📊 All-In-One Startup Metrics Guide - What to track, when and why

Resource page for founders we made here 📒

The information provided in this newsletter is intended for general understanding and educational purposes only, not as a guide to investment decisions. The authors, publishers, and distributors of this newsletter are not licensed financial advisors and are not providing financial advice or investment advisory services.s