A Note From the Redbud VC Team

We start Q4 with the government open, so there is some positivity. After Q3, the economy feels like it is taking a turn for the worse with mortgage rates breaking decade highs, consumer defaults rising, and student debt payments resuming. AI is keeping things interesting, as Open AI announced ChatGPT can now access current data — a must-watch is the new movie The Creator for a realistic outlook of AI vs. humankind. The drama on X has kept us entertained, from Accelerators to Aliens! Three successful IPO filings have kicked off this month, bringing late-stage valuations back to earth. Redbud VC’s home base, Columbia, MO, was recently ranked #1 in tech company growth, and local startup EquimpentShare closed another round of funding. Safe to say, the secret is out about the traction in the middle! 👀

If you are a Mizzou alum, check out our new alumni community for supporting student ventures and connecting with fellow alumni (stay tuned, more to come)🐯

Redbud VC invests monetary ($50k-$150k) and social capital in early-stage tech founders. We’re excited to bring you monthly Redbud VC, tech, and economics updates. - We've filtered thousands of sources for our 14k+ readers, so you don't have to. Enjoy🥂

🦸🏽 Become a Redbud VC Mentor | 📣 Pitch Us for an investment

😎 Join our talent network | 🛩 Flyover Tech community

Brutal trends in the US Housing market have us feeling like Mexico’s 1000-year-old aliens, and we don’t look much better either. It’s looking like there’s no glow-up insight 😬

🔥 Burning question of the month 🔥

The beef has been brewing between accelerator powerhouse Y Combinator and Neo Accelerator. Ali Partovi, founder of Neo, stirred controversy during his keynote speech at HackMIT when he compared his startup's mentor ratio to that of YC. Partovi’s comment upset YC CEO Garry Tan, who accused Neo of slander for suggesting that YC doesn't offer personalized advice. Partovi later told TechCrunch that he was surprised by Tan's reaction, asserting that he didn't make such claims and accusations of slander have legal ramifications😳 Michael Siebel even chimed in claiming he’s heard “so much dirt” on Partovi — really? YC must have deeper internal concerns to be so defensive to a much smaller firm that honestly said nothing that should have warranted a prominent public feud. Founders have been taking to X to share why they chose Neo over YC and vice-versa, which begs the question ⤵

If you were/are a founder and got into both YC and Neo, which would you choose?

📈 Macro Trend Report

HOUSING | The housing market still has heads spinning, and it’s looking like we’re not catching a break anytime soon. Home prices continue to rise despite increasing mortgage rates, currently set at 7.28% to 8% for 30-year fixed mortgages. Economists say that the underlying demand for homes with a disparate supply has kept prices high. The improbable imbalance of the market has some economists thinking that the housing market is irrevocably broken. The Fed didn't help the outlook for rates this week. At the conclusion of its September policy meeting, Jerome Powell said that the central bank wouldn't hike rates again this month but warned that they could remain elevated for longer. Even Zillow says the increases in prices aren’t stopping, as it expects home values to rise by 6.5% from July 2023 through July 2024 despite “persistent affordability challenges.” Looks like we’ll be forced to Zillow Stalk throughout 2024. 🥲

AI | Amazon is following VCs' lead everywhere by placing big bets on AI. Amazon announced they will invest up to $4B in AI startup Anthropic, starting with a modest $1.25B deployment of capital. The debate about AI replacing jobs rages on with the spotlight focused on Hollywood. The use of AI writing in media has been front and center of the SAG-AFTRA strikes. Founders remain adamant that AI is supplementing existing jobs, not replacing them. It’s too early to tell what will win out replacement vs. supplement, but it’s clear that the markets are bullish on AI. OpenAI announced that ChatGPT now has the ability to access current data, a game changer for startups and VCs. Data is arguably the most accessible it’s ever been, and the momentum is not stopping. OpenAI’s advancements overshadowed the launch of MetaAI, a personal assistant and chatbot from Meta, which launched on the same day. 🫣 More challenges are on the horizon as no significant AI legislation has been implemented in the US, and inaccuracies and language bias in LLMs continue to persist. Regardless of the challenges ahead, investors, individuals, and founders are taking stands on the direction that AI is moving. 👀

IPO FILINGS | Things feel a bit back to normal following the market debuts of Instacart, Klayvio, and Arm. All three set their prices at the upper end or even above recent expectations, resulting in an initial surge in their stock prices on their debut trading days. Prices have since mellowed. Klayvio and Instacart saw their shares briefly dip below their IPO prices, and Arm witnessed a remarkable 25% surge on its first trading day but then experienced a downward trend for the subsequent six days. It is crickets with direct listings — was that a zero interest phenomenon? While the past few IPOs haven’t opened the floodgates yet, a few companies are trickling in. Shoe giant Birkenstock filed for an IPO in mid-September, adding itself to the list of European companies choosing to be listed on the US Stock Exchange. “It’s safe to say the US is leading the [IPO] revival at this stage, and other financial centers, most notably London, have a lot of work to do to compete better going forward,” Craig Erlam, senior market analyst at Oanda, told CNN. (Sorry, Europe) 😉

VENTURE CAPITAL | As we patiently await for all of the Q3 venture data to drop at the end of the month, there’s been lots of buzz with LP/GP dynamics. The California State Teachers' Retirement System (CalSTRS), the second-largest public pension plan in the US with over $321B AUM, announced a partnership with Sapphire Partners to invest in five emerging fund managers. The CalSTRS partnership aims to support emerging managers during challenging fundraising periods, a strategy similar to other public pension plans like the Teacher Retirement System of Texas, which committed $5.9 billion to its emerging manager program. LPs are itching to stay in the market regardless of market cycles and aren't afraid to put their eggs in different baskets. This month, Pitchbook published a “how to pick a GP guide” for LPs, citing the key questions that should be answered and many surrounding investment alignment. Some LPs have also started to ask for GPs to link their carried interest to goals such as reducing carbon emissions or improving gender or racial representation on the boards of the fund's portfolio companies. No secret dynamics are changing, and we look forward to seeing how they shake out. Late-stage VC valuations continue to get hit as September IPOs have brought a picture of where valuations should be. Instacart raised a $39B valuation in 2021 and opened their IPO at $9B, a $30B haircut. Even Pitchbook says investors should continue to be prepared for steep discounts from pandemic-era highs. 💇🏽♀️

💰 Micro Trends

UNIVERSITY UNICORNS | Standford GSB professor Ilya Strebulaev dropped some great data on university unicorns this month. Stanford University leads the way with an impressive 207 companies founded by its alumni, followed by Harvard University with 164 and the University of Pennsylvania with 67. However, there is significant variation among states, with four states (Idaho, Hawaii, South Dakota, and North Dakota) having at most one unicorn founded by alumni at each university.🦄Ten states (Alabama, Delaware, Mississippi, Arkansas, West Virginia, Nebraska, Maine, Nevada, Montana, and South Carolina) have no more than two unicorns emerging from their top universities. The success of founders from elite universities is directly correlated with VC funding trends. 33% of all VC deals go to alumni of the VC's alma mater, and 40% of VC investors went to Harvard and Stanford, implying 13% of all VC deals are going to Harvard and Standford alums. Pitchbook also dropped its Top 100 Colleges for Startup Founders, with Stanford, Cal, and Harvard sitting in the top 3 spots.

Shoutout to our University of Missouri, emerging with 5 VC-backed unicorns, making it a top 30 alumni for billion-dollar startups. Redbud VC is working hard to get those numbers up through our partnership with Mizzou, founding the Technology Venture Studio 🫡

CREDIT UTILIZATION | Americans default on their credit cards and auto loans at the highest level in over a decade. In Q2 2023, the rate of new credit card delinquencies reached 7.2%, up from 6.5% in Q1. This rate, which measures loans that are 30 or more days overdue, is now higher than in the second quarter of 2019, which was prior to the pandemic's economic impact. Similarly, new auto loan delinquencies also increased, reaching 7.3% in the second quarter, compared to 6.9% in the first quarter. Both of these rates are surpassing pre-Covid levels. The average credit card interest rate is at a record high of 20.6%, which appears to keep climbing. Student loan payments, which have been paused for over three years, are poised to resume in October. Banks and other lenders have been clamping down on credit for months, a process that accelerated after the spring banking crisis. While Americans choose rent vs. credit payments, Visa and Mastercard are raking in the dough. Their combined operating profit has grown 40x in less than 20 years, to more than $31B last year. Both companies remain lean, with 50% to 65% of their revenue dropping into operating profit.

IPHONE HYPE | Gone are the days of camping outside of the Apple store; the new iPhone 15 dropped this month to rave reviews but not the same hype Apple launches used to garner. The new iPhones come as Apple’s sales fell for the third consecutive quarter last month. iPhone revenue came in at $39.7B for the quarter, marking an approximately 2% year-over-year decline as people update their devices less often. Google search volume for “new iPhone” has been on a steady decline, and the iPhone 15, despite its USB-C charging, is not immune. We’ve also seen horrible reviews on social media with the new iPhone overheating for no reason, Apple says it’s a software bug.

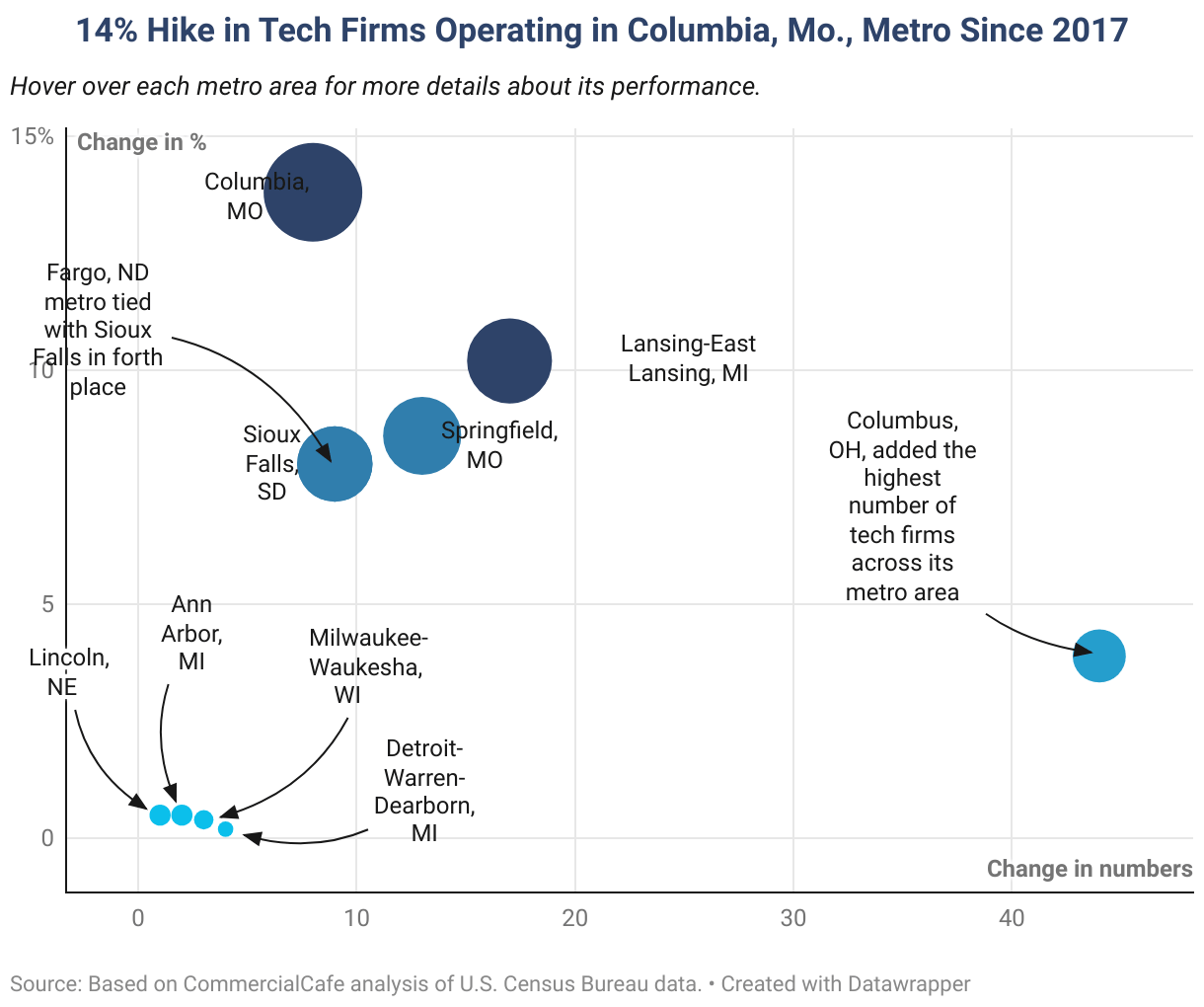

MIDWEST METROS | The rankings are out on the 20 Best Midwestern metro areas for tech development. Madison, Wisconsin, led the rankings with strong performances across several metrics, such as the ratio of tech employment opportunities and the highest earnings. Redbud’s home base, Columbia, MO, held our own at #7 overall and #1 in tech company growth. Columbia witnessed a 14% increase in the number of tech firms from 2017 to 2021 and #1 in the life-quality index by earning the second-lowest cost of living and the third-highest number of residents older than 25 who had a bachelor’s degree or higher. Let’s go COMO! 🏆

Columbia, MO-based EquipmentShare just closed another $150M in Series E Funding! Alongside the latest round of funding, EquipmentShare announced it is investing nearly $100 million in an expansion that will create over 500 jobs. The company’s new corporate headquarters will consist of a flagship office building, a research and development center, and additional space for offices and retail.

💰 Flyover Deals

Hot off the press, there were 319 flyover deals for over $3B in funding tracked here. Columbia, MO led he way for Missouri (thanks to EquipmentShare), ranking as the fifth city and pushing Missouri to being the fifth state 📰

Kansas City-based Sailes closed a $5.1M Series A led by our friends at KC Rise Fund!

Ohio-based startups saw a host of deals close this month 🔥

Pantomath closed the final touch of their $4M Seed Round

OSHA compliance platform, Soundtrace, closed a $2.5M Pre-Seed round led by Gutter Capital

Hybridwroks Chemical wrapped up a $3.4M Seed Round

Chicago-based Rent Butter, a tenant screening software, raised a $3M Seed Round

Minneapolis-based Fulcrum closed a $18M round of funding led by Bessemer Venture Partners

Nebraska-based assisted surgery developer, Virtual Incision, completed a $30 Million Series C

PatchRx, based in Tulsa, closed a $8M Series A led by Atento Capital and followed by Forum Ventures

Indy-based ConverSight completed a $9M Series A Round

🐮 Flyover vs. National Macro Trends

The Consumer Price Index was up 3% year-on-year in its most recent reading, way down on the peak reading of + 9.1% back in June 2022! The bad news: prices are still rising 🙃 The good news: just a slower rate 🙂

Unemployment in Missouri remains low at 2.8%, well below the steady national average of 3.8% and the Midwestern average of 3.9% ✅

Thanks to decreasing energy prices, the Midwest Consumer Price Index was at 3.1% this month, below the national rate of 3.8% ✅

🧠 This Month's Recommendations

📚 What We’re Reading

We’ve been reflecting on the rollercoaster of economic trends, and news blasted our way throughout 2023. This has kept us and others wondering…will the economy finally un-weird itself? 😵💫

AI is here! But is that good or bad? Read how that’s arguably neither in this OpEd from Alta on writers Accepting AI's Inevitability.

Yet another AI article - Sequoia Capital insights on AI’s $200B Question

What’s the best way to run a startup in a world FULL of advice?

Y Combinator’s Gary Tran goes to the mat - layoffs, shrunk batches, and dissolving the late-stage fund

🎧 What We’re Listening To

Thanks to our friend Joe Kaiser, MD at Mercato, we’ve religiously started listening to the Turpentine VC podcast. There is a wealth of insights on raising from LPs, portfolio construction, and building a top quartile fund.

From a $500B+ market cap wiped away from peak to trough, Nvidia is now back on the rise in the dawn of the AI era [2 hours 54 min]

Kickstarter CEO Everette Taylor on why work-life balance and empathy matter in your career [30 min]

Ever feel like meetings drain your joy and stop your productivity? Listen to Adam Grant chat about why meetings suck and how to fix them📝 [36 min]

Curious about the emerging manager trends we outlined above → the upfront ventures team chatted about their insights from the beginning of 2023 here [30 min]

Watching 👀: Duolingo’s method to their madness. How 23-year-old Zaria Parvez scaled Duolingo’s Tiktok to 6M followers and 650M views with a $0 marketing budget [14 min]

📆 What We’re Doing

We had a blast at Twin Cities Startup Week! 🌃 From fireside chats to pitches at Target Field, the week was packed full of great events, and we couldn’t be more excited about all of the startup activity happening in the Midwest!

Thank you to The Coven for providing a fabulous co-working space and to our friends at Groove Capital for hosting Angel Fest. 🥂

ZapConnect, Zapier’s free virtual user conference, was a true highlight of our month! ⚡️ Zapier CEO and Redbud VC advisor Wade Foster sat down with Open AI CEO Sam Altman to chat about harnessing AI and automation's power. It was great to listen to two Missouri natives share about their company-building journies. 💪

Zapier is hosting an in-person ZapConnect in the Bay Area on October 5th! Register here!

Heading to Chi-town for the M25 Summit the first week of Oct. Can’t wait to meet other capital allocators and catch up with our friends in Chicago 🏙

Making our way to KC the second week of Oct. for a reception our friends at InvestMidwest are putting on for the KC community. 😤

🎮 Flyover Picks of the Month

✨ hum

📍Detroit, MI

Hum accelerates subscriber growth, automates service operations, and increases profit for both service providers, and multifamily operators.

✨ Tromml

📍Durham, NC

Tromml offers powerful insights to automotive parts eCommerce sellers to improve profitability.

🚀 Redbud Portfolio Company Highlight of the Month

Meet Mattoboard, our latest Redbud VC investment! Mattoboard is building an interior design supplies marketplace. Through building a digital sample board tool and 3D virtual samples (VSamples), Mattoboard is replacing the billions wasted on material samples and facilitating transactions on the platform in continuity with real-time design.

Explore how Mattoboard is helping brands and designers waste less and create more. 🎨 ⤵

🛠️ Resources

Achieving great things is incredibly difficult, but you don’t have to do it alone! Formative is creating peer groups for the ambitious.

📣 Female Founders 📣 Lazy Girl Capital has put together a fantastic database of resources and communities; you won’t want to skip this one!

One of our new faves: funding exposure to top VC’s and Angels in a beautiful on-page format.

Decoding the Cap Table Puzzle - discover the components, pieces, and structure of what a cap table should look like 🧩

Lots of early-stage investors favor SAFE Notes. Check out this comprehensive guide to demystifying current and future SAFE terms.

The VC POV: Valuations → spoiler: if you’re a founder, this is the inside scoop!

✨ Looking for some inspo for your new deck design? Deck Gallery has got you covered!

Check out some fantastic insights on how to handle advisory shares!

Juggling dilution can feel like it never ends. Check out how to manage share dilution throughout rounds.

If you’re an early-stage founder, you have to check out this list of 1,000+ early-stage check writers

Resource page for founders we made here 📒

🤝 Collaborate with funds & founders in our Flyover Tech community

The information provided in this newsletter is intended for general understanding and educational purposes only, not as a guide to investment decisions. The authors, publishers, and distributors of this newsletter are not licensed financial advisors and are not providing financial advice or investment advisory services.3